Newsletters

2nd Quarter Newsletter 2023

In this issue:

- Director's Message – Market Research

- Rule Developments

- Mortgage 5-hour course reminder

- Division Staff Spotlight

- 4th Quarter Licensing & Disciplinary Actions

- Social media links

- Kagie's Korner – SA & LO Co-Marketing

- What your business needs to know (safeguard rules)

- Commission/Board Meetings & what the Commission does

- Appraisal

- Licensing application process

- 2023 Caravan Recap

- 2023 IDW announcement

- Credits

Director's Message —New Market Research (QR code-Qualtrics survey)

As mentioned last year, the Division of Real Estate hired a market research firm to gather data from Utah citizens who purchased, sold, financed, or refinanced a home in the 12 months preceding our research. During my CARAVAN presentation this year I shared some of the insights learned through four different focus group sessions held in November 2022. This article will highlight the most pertinent findings as well as announce our next plans for market research.

With the help of a market research firm, the Division held four focus groups that included 10-12 individuals who met the criteria outlined above.

Real Estate Agent Representation

When identifying factors that are most important in choosing a real estate agent, participants most frequently mentioned that good agents 1) have their clients’ best interests at heart, 2) possess good negotiating skills, and 3) are knowledgeable about all aspects concerning real estate.

Here is a breakdown of all factors mentioned by focus group participants

Other factors participants identified as important in selecting a real estate agent include:

- Access to resources

- Direct, straightforward advice

- Familiarity with an area

- Flexibility

- Hard worker

- Patient

- Not pushy

- Professional

- Punctual, timely with paperwork

- Organized

- Reliability

- Respectful toward buyers and sellers

- Reviews and recommendations from others

- Savvy

Participants overwhelmingly recommended using a real estate agent when purchasing a home.

When asked why they recommend using a real estate agent for purchasing a home, participants mentioned that real estate agents:

- Help buyers navigate complexities of buying a home

- Provide peace of mind to homebuyers

- Make the purchase process smoother and easier

- Protect the buyer in the event there are issues with the property

- Have knowledge and expertise that benefit both the buyer and seller

- Advocate for their buyers

- Alleviate the stress of buying a home

- Can help obtain the best deal on a piece of property

- Are knowledgeable about writing contracts

- Think of things a non-professional wouldn’t think of

Participants indicated that the value of real estate agents lies in their:

- Ability to navigate the home-buying process

- Knowledge and expertise

- Ability to do the legwork

- Handling of the paperwork

- Advocating for their clients

- Negotiation skills

- Access to homes

- Insight and information on a particular area

Three-quarters of participants indicated that they used a real estate agent during their most recent home purchase.

- Participants most frequently reported using an agent who is a friend.

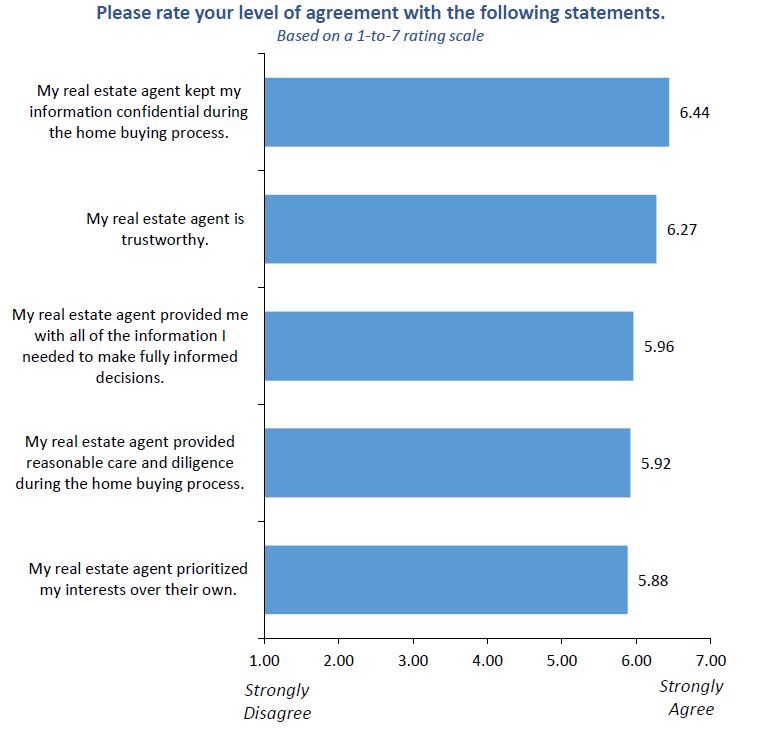

- Participants were generally satisfied with the representation they received from their agents, as they gave a satisfaction rating of 96 on a 7-point scale.

- When describing what their agents did well, many participants explained that their agents went above and beyond, exceeding their expectations.

- The majority of participants said they would use their real estate agent again for a future home purchase.

Participants were also asked to rate their level of agreement with certain statements about their experience.

When discussing frustrations they experienced with their real estate agents, participants most frequently commented that their agents: 1) did not prioritize their needs, 2) “dropped the ball” at some point in the process, 3) or aggressively pushed a particular lender.

Lender Experience

Nearly all participants indicated that they borrowed money to purchase their most recent home

- Participants most frequently found their lenders through a friend or through their real estate agent.

- Participants were generally satisfied with their lenders during the home-buying process, as they gave a satisfaction rating of 6.03 on the 7-point scale.

- Participants most frequently said they were satisfied with their lenders in terms of the following:

- Simple, easy process

- Fast closing

- Transparency, explanations

- Knowledge of the market

- Good rates

- Going above and beyond to close a loan

- The majority of participants indicated they would use their lender again in the future.

Participants who expressed frustrations with their lenders most frequently commented on the following:

- Lack of information from the lender

- Hidden fees

- Higher costs than originally quoted

- Lender “dropping the ball”

Most participants felt their lenders provided them with adequate information about their loans. In addition, participants felt they clearly understood most aspects of their loans.

Conclusion

The market research conducted by the Division of Real Estate indicates that the majority of participants were satisfied with the representation they received from their real estate agent and lender. The real estate and mortgage industries should be very encouraged by this information. The Division plans to continue performing market research starting with a new project this summer. We would like to survey licensees about their concerns and interactions with other licensees. This could be a real estate agent interacting with another agent, a lender interacting with an agent, an appraiser interacting with a lender or agent, an appraiser interacting with an appraisal management company, or many other scenarios. We need your help brainstorming ideas for questions to ask licensees. Please scan the QR Code below and submit your questions. We plan to conduct this market research in the near future, so please submit ideas as soon as possible.

Rule Developments Since March 1, 2023

Appraisal Management Company Rules

A bifurcated appraisal process has been introduced at a national level for some appraisals. In this type of appraisal, property data for the appraisal is provided by a third party, not the appraiser assigned to complete the appraisal. A proposed rule amendment would require an AMC that chooses to offer a bifurcated appraisal assignment to communicate to the appraiser information about who collected data for use in the appraisal assignment, when the data was collected, and other relevant information. In addition, the proposed rule would reduce the education requirement for AMC personnel who select an appraiser for an assignment or review the appraisal. The proposed rule amendment was submitted for review, first to the Division of Administrative Rules, and then to the Governor’s office. Several non-substantive changes have been made and the rule filing is currently being reviewed by the Governor’s Office a second time. The proposed rule amendment should soon be published for a period of public comment.

Appraisal

Mortgage

A proposed rule amendment is currently under consideration. If amended, the proposed rule would include:

- the oversight of loan originators and staff who telework;

- customer data security; and

- a requirement that a mortgage company notify its customers in the event of a suspected security breach if misuse of the customer’s personal information is likely to occur as a result of the security breach.

The proposed rule amendment was submitted for review, first to the Division of Administrative Rules, and then to the Governor’s office. Several non-substantive changes have been made and the rule filing is currently being reviewed by the Governor’s Office a second time. The proposed rule amendment should soon be published for a period of public comment.

Real Estate

A proposed rule amendment that would provide for:

- the designation of an acting principal broker in the event of the death or incapacity of a principal broker;

- additional core topics for continuing education;

- the easing of licensing qualification requirements for an applicant who is licensed as a broker in another state; and,

- other minor proposed changes.

The proposed rule amendment was submitted for review, first to the Division of Administrative Rules, and then to the Governor’s office. The rule filing has been approved by both the Division of Administrative Rules and the Governor’s Office. The proposed rule amendment should soon be published for a period of public comment.

Other possible rule amendments are being considered and committees formed. If these committees present a recommendation to the Real Estate Commission for changes to the administrative rules, the Commission will determine whether to propose additional rule amendments.

Timeshare and Camp Resort

Mortgage 5-Hour Post Licensing Course Reminder

Mortgage loan originators who were or will be either initially licensed or relicensed in Utah between November 1, 2022, and October 31, 2023, must complete the 5-Hour Utah MLO course before renewing their license for 2024. Licensees should complete this course after their Utah MLO license has been approved and before their first license renewal. This CE Course must be completed by October 21, 2023, to allow for a timely renewal when the renewal period commences on November 1st. If an MLO has not completed the course by October 21, 2023, they will be prevented from renewing until the course is completed and the hours have been banked on the NMLS.

MLOs who still need to complete the course can find providers for this course on the Division's Website or the NMLS website. To verify course completion, please check your Course Completion and Compliance Record on the NMLS by logging in to the NMLS, clicking on the Composite View tab, clicking on View Individual on the top sub-menu, then clicking on View Education Record on the left navigation panel. The NMLS Course Completion and Compliance Record will launch in a separate tab/window. Approved course providers have seven (7) calendar days from the course end date to bank a student's hours on the NMLS.

Thank you!

Division Staff Spotlight

Meet Bryn!

Bryn is the newest appraisal investigator to join our team and brings with her years of experience in the appraisal industry. Prior to joining the Division, Bryn worked as an independent appraiser for 20 years having received her training in Southern California. Her time as an appraiser in California allowed her many opportunities to appraise not only the best of the best but also the worst of the worst, from San Diego up through Malibu. Although Bryn misses the ocean, she is happy at home here in Utah where she enjoys the mountains and almost any outdoor activity. When outside, you can most likely find Bryn hiking, mountain biking, paddle boarding, horseback riding, swimming, playing pickleball, or tending to her garden. Bryn also loves exploring and enjoys hitting the road traveling through the US and Canada with her family and 2 dogs. Welcome to the Division, Bryn!

Bryn

Second Quarter Licensing & Disciplinary Actions

Please note that Utah law allows 30 days for appeal of an order. Some of the actions below might be subject to this appeal right or currently under appeal.

To view a copy of an order referenced in this article please visit the Utah Division of Real Estate Website under the Enforcement Menu, Disciplinary Actions

https://db.realestate.utah.gov/licensing-and-disciplinary-actions/

APPRAISAL/AMC

TIPPETTS, JAMES L, state-certified residential appraiser, Draper, Utah. In an order dated March 16, 2023, Mr. Tippetts’s license was reinstated and, due to a criminal matter occurring during the past licensing period, his license was placed on probation for the renewal period. Docket number RE-2023-033

MORTGAGE

There were no disciplinary or licensing actions in the mortgage industry in the second quarter.

REAL ESTATE

ABDI, KAMERON, sales agent, Cottonwood Heights, Utah. In an order dated April 11, 2023, Mr. Abdi’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-021

BELLINI, OCIMAR B, sales agent, Lehi, Utah. In an order dated April 3, 2023, Mr. Bellini’s license was renewed and, due to a pending criminal matter, his license was placed on probation for the renewal period. Docket number RE-2023-020

BROADHEAD, ALISHA LYNN BARBARA, sales agent, Mount Pleasant, Utah. In an order dated April 11, 2023, Ms. Broadhead’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-022

BULLARD, CLINTON JOSEPH, sales agent, Mountain Green, Utah. In an order dated May 23, 2023, Mr. Bullard’s license was renewed and, due to a criminal matter occurring during the past licensing period, his license was placed on probation for the renewal period due. Docket number RE-2023-034

COLMAN, ANDREW ALEXANDER, sales agent, Herriman, Utah. In an order dated April 11, 2023, Mr. Colman’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-023

DAVIS, JEREMY KEITH, sales agent, Washington, Utah. In an order dated April 24, 2023, Mr. Davis’s license was renewed and, due to a plea in abeyance in a criminal matter occurring during the past licensing period, his license was placed on probation for the renewal period. Docket number RE-2023-027

FENWICK, DANA LYNN, sales agent, Clearfield, Utah. In an order dated May 5, 2023, Ms. Fenwick’s license was renewed and, due to a criminal matter occurring during the past licensing period, her license was placed on probation for the renewal period. Docket number RE-2023-032

FLORES-URANGA, XOLEDAD LORETXU, sales agent, Salt Lake City, Utah. In an order dated March 20, 2023, Mr. Flores-Uranga’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-013

GAYTAN, JUAN PAVEL ARELLANO, sales agent, Sandy, Utah. In an order dated March 29, 2023, Mr. Gaytan’s license was granted and placed on probation for the initial licensing period due to a plea in abeyance in a criminal matter. Docket number RE-2023-018

GIHANA, BRIAN, sales agent, Taylorsville, Utah. In an order dated March 20, 2023, Mr. Gaytan’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-014

HAMILTON, MICHAEL ANGELO, sales agent, West Valley City, Utah. In an order dated March 22, 2023, Mr. Hamilton’s license was reinstated and, due to a plea in abeyance agreement occurring during the past licensing period, his license was placed on probation for the renewal period. Docket number RE-2023-017

HEIDER, AMY LEE, sales agent, Salt Lake City, Utah. In an order dated March 20, 2023, Ms. Heider’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-015

HOLLAND, JOSEPH B., principal broker, Salt Lake City, Utah. In a stipulated order dated April 19, 2023, Mr. Holland admitted to having failed, within a reasonable time, to remit or account for monies belonging to his principal, the property owner, and having failed to uphold the fiduciary duties owed to his principal. In this case, the agency agreement required owner approval for any expenditures over $500 and provided that the property manager secure liability insurance naming the owner as the insured and the property management company as co-insured. An insurance policy was secured in the name of the owner only. A lawsuit arose following a water leak and the owner, Mr. Holland, and the property management company were named as co-defendants. The insurance company’s attorney represented the owner. Mr. Holland hired an attorney to represent him and the property management company. Without the owner’s prior approval or consent, several payments from the owner’s account totaling $9,289.02 were used to pay the attorney fees for Mr. Holland and the property management company. Eventually, all claims in the lawsuit against Mr. Holland and the property management company were dismissed. By stipulation with Division, Mr. Holland agreed that he should complete six hours of continuing education, in addition to the continuing education required for his next licensing renewal cycle, and that he pay a civil penalty in the amount of $14,289, with a dollar-for-dollar credit up to $10,000 for monies returned to the owner. Docket number RE-2022-008 and Division case number RE-20-116148

KIFER, MERVIN, associate broker, Orem, Utah. In an order dated March 29, 2023, Mr. Kifer’s license was renewed and, due to a criminal matter occurring during the past licensing period, his license was placed on probation placed on probation for the renewal period. Docket number RE-2023-019

MALAN, JADEN ROBERT, sales agent, Pleasant Grove, Utah. In an order dated April 27, 2023, Mr. Malan’s license was renewed and, due to a plea in abeyance agreement occurring during the past licensing period and other criminal charges pending at the time of renewal, his license was placed on probation for the renewal period. Docket number RE-2023-028

MORGAN, SARAI, sales agent, Tampa, Florida. In a stipulated order dated May 17, 2023, Ms. Morgan admitted that she failed to notify the Division that she had entered into a plea in abeyance agreement with regard to a charge of theft of services, a class A misdemeanor and that her failure to do so is a violation of Utah law. The law requires a licensee to send the Division a signed statement within ten business days of a conviction, or the entry of a plea in abeyance agreement, with regard to a charge of theft or certain other charges. Ms. Morgan agreed to pay a civil penalty of $1,000. Case number RE-22-134033

MOORE, HUNTER SIERRA, sales agent, Roy, Utah. In an order dated March 9, 2023, Mr. Moore’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-012

POELMAN, KADE, sales agent, Harrisville, Utah. In an order dated April 27, 2023, Mr. Poelman’s license was reinstated and, due to a criminal matter occurring during the past licensing period, his license was placed on probation for the renewal period. Docket number RE-2023-029

SNIDER, DARNELL, sales agent, Roy, Utah. In an order dated April 18, 2023, Mr. Snider’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-026

SHAW, JEFFREY RYAN, sales agent, St. George, Utah. In a stipulated order dated April 19, 2023, Mr. Shaw admitted to having violated Utah administrative rule when he placed a sign on a property prior to obtaining written consent of the property owner and advertising a property on the MLS prior to obtaining the written consent of the owner of the property. Mr. Shaw agreed to pay a civil penalty of $1,000 and to complete three hours of continuing education in addition to the continuing education required for his next license renewal. Case number RE-20-115956

TRUJILLO, JALEN LEONARD, sales agent, Riverdale, Utah. In an order dated April 18, 2023, Mr. Trujillo’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-025

ULRICH, MATTHEW M, sales agent, South Jordan, Utah. In an order dated May 23, 2023, Mr. Ulrich’s license was renewed and, due to a criminal matter occurring during the past licensing period, his license was placed on probation for the renewal period. Docket number RE-2023-031

VOTRUBA, ALEXANDER ROBERT, sales agent, Salt Lake City, Utah. In an order dated May 31, 2023, Mr. Votruba’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-035

WATTS, KODY M, sales agent, South Jordan, Utah. In an order dated March 20, 2023, Mr. Watts’s license was renewed and, due to a plea in abeyance agreement occurring during the past licensing period, his license was placed on probation for the renewal period due. Docket number RE-2023-016

TIMESHARE

Social media links

Did you know……

The Division of Real Estate is on Facebook and Instagram making it easier than ever to stay connected and in the know!

Both are great places to stay up to date on renewal dates, deadlines, rule and industry updates, event announcements, and much more. Click the links below and be sure to follow our pages!

Kagie's Korner – SA & LO Co-Marketing

Can a mortgage licensee advertise real estate? Can a real estate licensee advertise mortgage terms?

The Division receives complaints and inquiries involving loan officers that are marketing real estate for sale while not being licensed as real estate professionals and real estate licensees marketing loan origination rates and fees while not being licensed as mortgage loan originators.

Mortgage licensees who advertise a property with specific marketing details of the property such as a listed price, number of bedrooms, baths, square footage, open house times, etc. would be considered holding themselves out as a real estate broker or agent which would require them to hold an active real estate license.

R162-2c-301a. Unprofessional Conduct

- Mortgage Loan Originator

(b) Prohibited Conduct…A mortgage loan originator may not:

(v) Unless acting under a valid real estate license and not under a mortgage license, perform any act that requires a real estate license under Title 61, Chapter 2f, Real Estate Licensing and Practices Act, including:

(D) Advertising the sale of real estate by use of any advertising medium;

As a mortgage licensee, you can only market the loan origination services that you hold a license for, the law does not allow you to also market real estate. Additionally, State Statute prohibits individuals that hold both a mortgage origination license and a real estate license from using both licenses in the same transaction.

61-2c-301(1)(i) Prohibited Conduct:

(i) engage in the business of residential mortgage loans with respect to the transaction if the person also acts in any of the following capacities with respect to the same residential mortgage loan transaction:

-

-

- appraiser;

- escrow agent;

- real estate agent;

- general contractor; or

- title insurance producer;

-

Real estate licensees can be in violation of the mortgage statute if they market an interest rate or other loan terms in their advertisements.

Utah Residential Mortgage Practices and Licensing Act:

61-2c-201 Licensure required of person engaged in the business of residential mortgage loans.

- (a) Except as provided in Subsection (1)(b), a person may not transact the business of residential mortgage loans without first obtaining a license under this chapter.

Additionally, real estate administrative rules prohibit individuals that hold both a real estate license and a mortgage origination license from using both licenses in the same transaction.

R162-2f-401b. Prohibited Conduct As Applicable to Licensed Individuals.

- An individual licensee may not:

(n) act as a real estate agent or broker in the same transaction in which the licensee also acts as a:-

- mortgage loan originator, associate lending manager, or principal lending manager;

- appraiser or appraiser trainee;

- escrow agent; or

- provider of title services;

-

CO-MARKETING?

When a mortgage licensee and real estate licensee co-market together they must both contribute to the cost in proportion to the size of their space in the advertisement. If the real estate licensee’s portion of the ad takes up two-thirds of the ad then they must contribute two-thirds of the expense for the advertisement. The mortgage licensee cannot pay for the real estate licensee’s portion of the ad as this would be a violation of 61-2c-301(1)(a), a person transacting the business of residential mortgage loans in this state may not: (a) violate Section 8 of RESPA. RESPA, Section 8(g)(1)(vi), states:

- Section 8 of RESPA permits:

iv. Normal promotional and educational activities that are not conditioned on the referral of business and that do not involve the defraying of expenses that otherwise would be incurred by persons in a position to refer settlement services or business incident thereto

If a real estate licensee pays for all or a portion of a mortgage licensee’s advertisement, or vice versa, this would be the defraying of expenses that otherwise would be incurred by persons in a position to refer settlement services or business incident thereto…

The Division recommends reviewing RESPA and the statute and rules prior to entering into a co-marketing arrangement. Otherwise, market separately which would allow a licensee to shine in their own industry, and allow the general public to clearly understand who is performing which function in the transaction.

What your business needs to know (safeguard rules)

Gramm-Leach-Bliley Act and FTC Safeguards Rule

The extended deadline given to financial institutions covered by the Gramm-Leach-Bliley Act to develop and implement the revised Safeguards Rule ended June 9th, 2023. If you haven’t already, you will want to read the FTC Rule to see if your business is included in the “financial Institution” definition. If the rule covers your business, here are a few resources to aid your company in implementing an information security program.

How to comply with the Privacy of Consumer Financial Information Rule of the Gramm-Leach Bliley Act.

Commission/Boad Meetings & what the Commission does

by Laurel North | Lead Investigator

As in all good government, there is a system of checks and balances, or separation of powers, organized within the Division of Real Estate. By design, the Division is only one part of the functioning regulatory arm whose motto is “Strengthening trust in Utah’s real estate industry through education, licensure, and regulation of real estate, mortgage, and appraisal professionals.”

The Real Estate, Mortgage, and Appraisal industries are bound by the statutes constructed by the Utah Legislature and the administrative rules created by each industry’s Commission or Board.

The content of this article is to highlight the “rule-making arm” of each industry’s Commission or Board within the Division which helps ensure the maintenance of a healthy separation of regulatory power along with equitably strengthening trust in our community.

Real Estate Commission §61-2f-103

The Real Estate Commission is made up of five Commissioners, four industry-licensed and experienced members, and one member of the public. Commissioners are all appointed by the Utah Governor and confirmed by the Utah Senate. A Commissioner’s term of service is four years and can be renewed for one more consecutive term. Statute requires that the Real Estate Commission meet monthly.

Some of the rulemaking* duties of Real Estate Commissioners include:

- Licensing and registering licensees;

- Generating pre-licensing and post-licensing education curricula;

- Creating examination procedures;

- Certifying real estate schools, providers, and instructors;

- Ensuring proper handling of monies received by a licensee;

- Building brokerage office procedures and recordkeeping requirements;

- Constructing Property management requirements; and,

- Assembling standards of conduct for each licensee.

*All rulemaking requires the concurrence of the Division Director

The Real Estate Commission also conducts administrative hearings relating to licensing, licensee conduct, certification, and with the concurrence of the Division Director, imposes sanctions against licensees, real estate schools, course providers, and instructors found in violation.

Residential Mortgage Regulatory Commission §61-2c-104

The Residential Mortgage Regulatory Commission (Mortgage Commission) is made up of five members, four are licensed in the mortgage industry, and one member of the public. Commissioners are appointed by the Executive Director with the approval of the Utah Governor. Their term of service is four years and the Executive Director may reappoint a commissioner. Statute requires that the Mortgage Commission meet at least quarterly.

Some of the rulemaking* duties of Mortgage Commissioners include:

- Concurring in the licensure or denial of licensees;

- Advising the division concerning matters related to administration and enforcement;

- Determining Utah specific pre-licensing and renewal education along with establishing experience requirements for licensure;

- Establishing rules and regulations; and,

- Instituting reporting requirements.

*All rulemaking requires the concurrence of the Division Director

The Mortgage Commission, with the concurrence of the Division, may impose sanctions against licensees and entities found in violation.

Real Estate Appraiser Licensing and Certification Board §61-2g-204

The Real Estate Appraiser Licensing and Certification Board (Appraisal Board) is made up of seven members, four are licensed appraisers, one from the mortgage industry, one from an appraisal management company, and one member of the public. Board Members are appointed by the Utah Governor with the advice and consent of the Utah Senate. Their term of service is four years and can be renewed for one more consecutive term. Statute requires that the Appraisal Board meet at least quarterly.

Some of the rulemaking* duties of Appraisal Board Members include:

- Providing technical assistance relating to general appraisal standards and qualifications;

- Determining experience and education requirements for licensure;

- Determining continuing education for license renewal; and,

- Interpretation and explanation of the Uniform Standards of Professional Appraisal Practice.

*All rulemaking requires the concurrence of the Division Director

The Appraisal Board also conducts administrative hearings in connection with disciplinary proceedings and, with the concurrence of the Division Director, issues decisions that contain findings of fact, conclusions of law, and disciplinary sanctions.

All of the above-mentioned Commissioners and Board Members serve as valued members of committees that regularly discuss industry concerns and current issues to ensure that the Division remains informed and progressive on all fronts.

The Commissions and Board usually meet monthly but occasionally meet more often for special circumstances or may meet less often if there is little business to discuss. If you’d like to join a virtual Commission or Board meeting, scroll down to the bottom right of the Division’s homepage https://realestate.utah.gov/ and click on the Calendar Icon to see when the meetings are scheduled. Please contact our Board Secretary, Maelynn Valentine, mvalentine@utah.gov for a link to the meeting a few days before the meeting is scheduled to take place.

Check out the Division website to identify who your representative Commissioners or Board Members are along with past public meeting agendas, minutes, and statistics. You can find this information within each industry’s specific homepage on a tab marked Real Estate Commission, Mortgage Commission, or Appraiser Board.

We appreciate our partnerships with the Commissioners and Board Members as we work together to provide thoughtful, fair, and reasonable governance for our licensees.

Appraisal

Quality and Condition Considerations

By Bryn Kaelin, Appraisal Investigator

When completing an appraisal report, the condition rating selected for the subject property and comparable sales should reflect a holistic view of the condition of the property improvements. It would be misleading to report a lower or higher overall rating on the absence of or based on only one minor inferior or superior area of the property.

I often see appraisal reports that state the subject is 50 years old, with a condition rating of C3, and a statement of no prior updates. The photograph addendum shows a home in its original condition with little to no updates, original flooring, and appliances. In that instance is the C3 rating reflective of the condition of the subject? Further, in the same report, sales comparables of a similar nature are given a C4 condition rating on the sales grid with an upward adjustment. This determination lacks consistency and misleads both the condition of the subject and the sales comparables which diminishes the credibility of the assignment results.

Just recently I ran into a condition reporting issue pertaining to an investigation that I was conducting. Presented before me were two appraisal reports for the same subject property, completed by the same appraiser, dated within four months of each other. The subject was rated Q3/C3 condition in both reports with a reported estimate opinion of value discrepancy of $80,000. What was the difference? Updates and remodeling? The first report reflected a home in its original condition. The second report reflected updates with new flooring throughout, remodeled kitchen, and updated bathrooms. A more accurate C4 determination of condition in the original report and a C3 reporting in the second appraisal would have been more consistent with the UAD definition and guidelines and would have produced clear and transparent results.

Another item frequently found throughout appraisal review is combining a determination of upgrades, quality, condition, and sometimes even age adjustments within the sales grid on a single line item. Combining all these adjustments into one single line item makes it difficult to discern the basis of the adjustment. Keeping the adjustments separate allows for consistency and clarity when reporting similarities and accounting for differences.

It is important to remember to be clear, consistent, and unbiased in the reporting of information throughout the report. The more accurate and transparent we can be in our reporting throughout our assignments, the greater the likelihood that the intended users can easily and clearly understand our reports.

Licensing application process

ATTENTION: Brokers and New Real Estate Salesperson Applicants

Recently, Pearson VUE real estate testing centers have modified their process for submitting sales agent licensing applications. Pearson VUE will now only supply successful testing candidates with a single-page passing score sheet. This one-page document will contain three electronic links.

- The first link will direct candidates to a four-page application document (please read carefully and include dates and signatures where required).

- The second link will direct candidates to a Fingerprint Consent Form. (please read carefully and include name, address, date of birth, signature, and date where required).

- The third link is for the submission of completed salesperson application documents to the Utah Division of Real Estate.

IMPORTANT: This link should only be used to submit salesperson application documents to the Division if fingerprinting occurred at a Pearson VUE testing center.

For candidates that were NOT fingerprinted at a Pearson VUE testing center (i.e. police station, or private fingerprinting vendor), they should NOT use this link. Rather, they should mail their two fingerprint cards, completed application, and forms to:

The Utah Division of Real Estate

P.O. Box 146711

Salt Lake City, UT 84114-6711

Please follow the instructions outlined in this article to successfully and timely transmit your completed real estate salesperson application forms and documents to the Division. This will enable Division staff to process your application in the most efficient and judicious manner.

2023 Caravan Announcement

This year the Division held nine CARAVAN training sessions in nine different cities or towns throughout the state: Vernal, Provo, Park City, Layton, Moab, Richfield, Cedar City, St. George, and Logan.

Division Staff member participants included: Jonathan Stewart, Division Director, Mark Fagergren, Licensing and Education Director, Kadee Wright, Chief Investigator, Sandra Bargas, Real Estate Education Coordinator, and Lark Martinez, Mortgage Education Coordinator.

We shared three hours of timely and interesting training and conversation pertaining to the real estate, mortgage, and appraisal professions which the Division regulates throughout Utah. At no cost, licensees received three hours of informative traditional classroom continuing education.

We wish to thank this year’s participants for their time and input and await our meeting once again next spring for the 2024 CARAVAN.

2023 Instructor Development Workshop

October 2023

The Division is excited to announce that plans for our annual Instructor Development Workshop (IDW) are underway! It will be held later this year in October so keep an eye out for more information to come!

Attendance at the two-day IDW is REQUIRED once every two years for all real estate, mortgage, and appraiser pre-licensing instructors and real estate continuing education instructors who teach any of the Mandatory Courses. Mortgage and appraisal CE instructors are invited and encouraged to attend this workshop, but please remember that no CE credit can be given. Only Real Estate instructors (pre-license and continuing education) and attending real estate licensees will be eligible to receive core continuing education credit for attendance at this outstanding training event. As a reminder, CE credits are only awarded in full-day segments.

Registration and other important information such as the exact date, location, and speaker will be available shortly both via email and on our website. If you have any questions, please feel free to contact Sandra Bargas at sbargas@utah.gov. We will see you in October!

Credits

Director: Jonathan Stewart

Editor/Contributor: Mark Fagergren

Contributor/Layout: Sandra Bargas

Contributor/Layout: Lark Martinez

Contributor: Kadee Wright

Contributor: Justin Barney

Contributor: Van Kagie

Contributor: Laurel North

Webmaster: Jason Back

2023 Published by

Utah Division of Real Estate

Department of Commerce

160 E 300 S

PO Box 146711

SLC UT 84114

(801) 530-6747

Real Estate Commissioners

James Bringhurst, Chair

Randy Smith, Vice Chair

Marie McClelland

Rick Southwick

Andrea Wilson

Mortgage Commissioners

Jeff England, Chair

Jeff Flinton, Vice Chair

Kay R. Ashton

Allison Olsen

George P. Richards

Appraiser Licensing and Certification Board Members

Jeffrey T. Morley, Chair

Keven Ewell, Vice Chair

Ben Brown

Kris Poulson

Richard Sloan