Newsletters

4th Quarter 2022 Real Estate Newsletter

In this issue:

- Director's Message – Market Research

- Rule Developments Since June 1, 2022

- Mortgage Renewals 2023

- Division Staff Spotlight

- 2023 Mandatory Course Outlines & Updates

- Thank You and Welcome Commissioners and Board Members

- 4th Quarter Licensing & Disciplinary Actions

- Kagie's Korner — New Electronic Complaint Process

- Who's on Title

- Instructor Development Workshop 2022 Recap

- 2023 Caravan Announcement

- Vacant Land Fraud

- Distributing Commissions — Title Companies

- Credits

Director's Message — Division Updates

As mentioned in our 3rd Quarter Newsletter, the Division of Real Estate hired a market research firm to gather data from Utah citizens who have purchased, sold, financed, or refinanced a home in the last 12 months. I would like to share some of the insights learned from the survey portion of our market research.

Research Objectives

- Do Utah residents believe that they received adequate representation when they purchased or sold a home?

- When these individuals purchased or sold a home, do they believe they had all the information they needed during the process?

- Did those who purchased or sold a home feel that there were any problems that occurred during the process that could have been avoided with the proper information and/or representation?

- The same questions were asked of those who financed their home purchase or refinanced their primary residence.

Findings

Real Estate

- 62% were first-time homebuyers

- 79.5% used some type of representation for their transaction

- 83.5% of those who used representation used a real estate agent or broker

- 38.8% of representation represented both the buyer and seller

- 56.3 identified trustworthiness as the number one factor in selecting their representation

- 83.6% of respondents gave their representation either a 4 or 5 rating (out of 5) the last time they purchased a home, indicating a high level of satisfaction.

- 69.4% believed that their representation was loyal to them during the transaction

- 73.1% believed their representation kept their information confidential

- 68.9% believed their representation provided them with reasonable care and diligence

The average net promoter score for real estate representation in the United States is 30. The net promoter score of those we surveyed was 36.3. The higher the net promoter score the more satisfied they are with their representation. Based on our survey results, those who used a real estate agent or broker to represent them were more satisfied with the representation they received than the average for the United States.

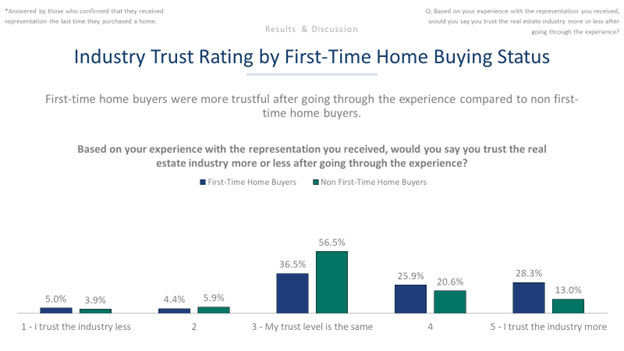

We asked respondents if they trust the real estate industry more or less after completing their transaction. The following graph breaks out first-time home buyers and non-first-time home buyers.

Mortgage

- 79.5% borrowed money when purchasing their home

- 57.4% used a mortgage company when borrowing money

- 68.2% of borrowers did not believe there were problems during the borrowing process that could have been avoided with the proper information and/or consultation provided by their lender

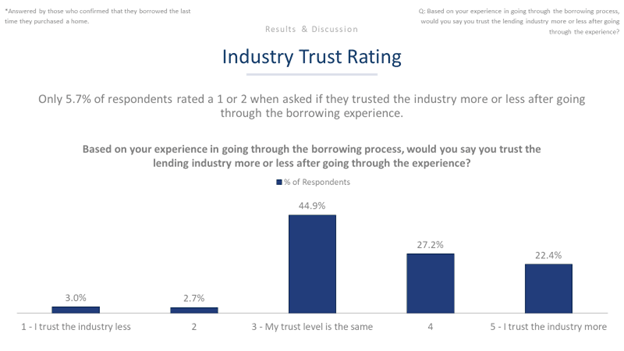

Similar to real estate, we asked respondents if they trust the mortgage industry more or less after going through the process. The following graph illustrates their responses.

Conclusion

These survey results indicate that most Utah residents who have been through the home-buying process in the last 12 months strongly believe that they received adequate representation. When individuals received adequate representation, there was a strong correlative effect in having more trust in the industry. In the same vein that respondents believe they received quality representation, they also believed that they had the information they needed during the process. In addition, if individuals trusted their representation, they were the number one resource that individuals would refer to when having questions about the process. The major themes observed in the core research questions were echoed in the borrowing, lending, and refinancing responses.

The results of our market research are very encouraging. While it does not remove the need to always improve, licensees should feel good about how the public views the representation and service they are receiving. Thank you for all you do for our great state. I hope you all have a Happy New Year and a successful 2023!

Rule Developments since September 1, 2022

To view and comment on any proposed or amended rules during the public comment period, please visit the Utah State Bulletin at https://rules.utah.gov/publications/utah-state-bull/

Appraisal Management Company Rules

A proposed rule amendment is currently under consideration.

A bifurcated appraisal process has been authorized and utilized by some federal agencies for limited appraisal assignments. In this type of appraisal, property data for the appraisal is provided by a third-party, not the appraiser assigned to complete the appraisal, and in some instances by a non-appraiser or appraiser trainee. A proposed rule amendment would require an AMC that chooses to offer a bifurcated appraisal assignment to communicate to the appraiser information about who collected data for use in the appraisal assignment, when the data was collected, and other relevant information.

In addition, the proposed rule would reduce the education requirement for AMC personnel who select an appraiser for an assignment or review the appraisal.

The proposed rule amendment is moving through the approval process. It is currently under review by the Department of Commerce and will be reviewed by the Governor's Office. After these reviews it will be published for a 30-day public comment period.

Appraisal

There are currently no proposed rule amendments under consideration for The Real Estate Appraiser Licensing and Certification Rule.

Mortgage

A proposed rule amendment is currently under consideration. If amended, the proposed rule would include:

- the oversight of loan originators and staff who telework;

- customer data security; and

- a requirement that a mortgage company notify its customers in the event of a suspected security breach if misuse of the customer's personal information is likely to occur as a result of a security breach.

The proposed rule amendment is moving through the approval process and will be reviewed by the Department of Commerce and the Governor's Office. After these reviews it will be published for a 30-day public comment period.

Real Estate

A proposed rule amendment is currently under consideration. If approved, the proposed rule would include:

- the designation of an acting principal broker in the event of the death or incapacity of a principal broker;

- additional core topics for continuing education;

- the easing of licensing qualification requirements for an applicant who is actively licensed as a broker in another state; and

- other minor proposed changes.

The proposed rule amendment is moving through the approval process and will be reviewed by the Department of Commerce and the Governor's Office. After these reviews it will be published for a 30-day public comment period.

Timeshare and Camp Resort

There are currently no proposed rule amendments under consideration for the Timeshare and Camp Resort Rules.

Mortgage Renewal 2023

2022 has ended, and so too has the mortgage license renewal period. This year, in addition to the Utah specific requirement of the 2-hour Utah Law Course, mortgage loan originators (MLOs) that were licensed between November 1st, 2021 and October 31, 2022 were required to complete the 5-hour Utah MLO Course before they could renew their MLO license for 2023. The 2-hour Utah Law Course and the 5-hour Utah MLO Course (if required) are in addition to the 8 hours of Federal CE which is required nationally for all renewing mortgage licensees. Both the 2-hour Utah Law Course and the 5-hour Utah MLO Courses are tracked through the NMLS.

Overall, our 2022 renewal period was carried out without any major complication, considering that on November 1st there were 12,267 licenses eligible to renew for 2023. Our staff received customary questions from industry through phone calls, e-mails, and live chats regarding state-specific renewal requirements. At the time of this writing, 67% of our licensees have requested renewal and 93% have been approved. As of this date, 584 applicants have not yet had their renewal applications approved and 3874 have not yet requested their renewal.

In addition to receiving a confirmation email from the NMLS stating that your renewal has been approved, you will also receive an email from the Division of Real Estate with your mortgage license attached. You may print your license at your convenience.

If however, you have not received an email confirmation through the NMLS system that your license renewal is approved and you requested your renewal more than two weeks ago, please log into your NMLS account and see if there are deficiencies posted on your license (license items) that are holding up the renewal. Please check your NMLS account in the following manner:

Log in to your NMLS account: Click the "composite view" tab at the top of the screen, then click the "View individual" link from the submenu at the top of the screen, click the "view license/registration list" link on the left navigation panel and then select your Utah license and the license status will display, click on the hyperlinked number under the "License Items" column to view the license item information screen, item details will display under the "Active License Items" section. License items indicate that there are corrections or additions required in your NMLS account. Generally, for individuals, these items are to complete continuing education requirements, or a request to update your employment history, which can be taken care of fairly easily. For entities, the license item is predominately a request for an updated Certificate of Existence that needs to be uploaded to the entities MU1 filing under the Certificate of Authority/Good Standing option. Other reasons for a license item could be failing to provide required documentation or failure to respond to a request from the division. If you need help updating your NMLS record, please contact the NMLS Call Center at (855)-665-7123.

If you requested renewal prior to the December 31, 2022 deadline, and you have no license item requirements, you may continue to use your license according to your license status as of the day you requested your renewal in the NMLS, while we review your application. If you failed to request your renewal before the end of the year or failed to complete license item requirements, you should immediately discontinue any activity that requires a mortgage license until you have a renewal approved by the Division.

For individuals who fail to complete annual attestation and request renewal by December 31st, the division offers a reinstatement period. This period begins January 1st, 2023, and runs through February 28th, 2023.

You will need to complete all continuing education requirements, the 2022 Late CE, the 2-hour Utah Law course, and the 5-hr Utah MLO course (if required), request your renewal through the NMLS, pay the renewal fee and a $50 late fee. If you completed your CE prior to the end of the year, but did not request renewal, you will not need additional CE, you will just need to request renewal and pay the renewal and late fee through NMLS prior to February 28th, 2023. For more information on how to request a late renewal, please visit NMLS renewal resource center using this link: https://mortgage.nationwidelicensingsystem.org/slr/common/renewals/Pages/default.aspx

Please note the importance of the February 28th deadline. After that date, licensees who wish to reapply for a Utah mortgage license will need to meet all requirements for a new license. If you have questions please contact the Utah Division of Real Estate at (801) 530-6747. For help navigating the NMLS website please contact the NMLS Call Center at (855)-665-7123.

Division Staff Spotlight

Meet Melissa! Melissa joined the Division of Real Estate as an appraisal licensing specialist in earlier this year but has worked for the State of Utah for almost 10 years! Born and raised in Utah she has a love for the outdoors and enjoys camping. She has three kids (the four-legged kind!) and their names are Pippin, Wylee, and Tootsie. When she isn't at work she enjoys reading, crafting, and cooking. Melissa loves working for the Division and has enjoyed getting to know the team and learning about all of the different licensing processes. We are truly lucky to have her!

Melissa McGill

2023 Mandatory Course Outlines & Updates

Changes to the 2023 Mandatory Course Outlines have been discussed and approved by the members of the Real Estate Commission and the Division. Each of the three Mandatory Course specialty outlines include significant changes:

- Mandatory Residential;

- Mandatory Commercial;

- Mandatory Property Management (residential or commercial);

At the first of the year approved Mandatory Course Instructors and Providers will initiate the use of the new 2023 Mandatory Course (core topic) Outlines.

Remember that all active real estate licensees need to complete (at least one) 3-hour Mandatory Course to satisfy part of their 18 hour continuing education (CE) renewal requirement. CE courses may be a combination of CORE topic courses and Elective Courses.

A minimum of 9 CORE topic course hours must be completed and of those 9 CORE topic course hours, 3 of those hours MUST be a Division approved 3-Hour Mandatory Course.

Licensees may select any of the three specialties of the Mandatory Couse that best meets their individual market area of focus (Mandatory Residential, Mandatory Commercial, or Mandatory Property Management (residential or commercial).

Licensees may elect to complete more than a single mandatory course specialty for CE credit if they choose to do so, although they may only receive CE credit for one Mandatory "Residential", "Commercial", and/or "Property Management" course in the same renewal cycle. In other words, a licensee could choose to attend more than one Mandatory Course specialty (i.e. "Residential", "Commercial" or "Property Management"), but NOT take more than one course for CE credit from the same Mandatory Course Specialty in the licensees' same renewal cycle.

The Division and Real Estate Commission are confident that the 2023 Mandatory Courses will include timely information that will inform you and enhance the likeliness of your success in your real estate careers.

Thank You and Welcome Commissioners and Board Members

The Division would like to thank George Richards and Scott Gibson who both served on the Residential Mortgage Regulatory Commission. Thank you for your time, professionalism, and the service you gave the citizens of Utah, the mortgage industry, and the Division of Real Estate. We will miss working with both of you.

The Division would also like to welcome Christy Vail and Jeff Flitton to the Mortgage Commission. Marie McClelland and Rick Southwick were reappointed to the Real Estate Commission and Richard Sloan was reappointed to the Real Estate Appraiser Licensing and Certification Board. We look forward to serving with you and appreciate your willingness to give back to your industry and to the public. Thank you!

Fourth Quarter Licensing & Disciplinary Actions

Please note that Utah law allows 30 days for appeal of an order. Some of the actions below might be subject to this appeal right or currently under appeal.

To view a copy of an order referenced in this article please visit the Utah Division of Real Estate Disciplinary Actions Search at: https://db.realestate.utah.gov/licensing-and-disciplinary-actions/

APPRAISAL/AMC

WADE, CHRISTOPHER M., temporary practice application, Irvine, California. In an order dated September 2, 2022, the Division denied Mr. Wade's application for temporary practice as a certified general appraiser due to his failure to disclose in his application a citation issued by another jurisdiction. Case number AP-22-137258

MORTGAGE

There were no disciplinary or licensing actions in the mortgage industry in the fourth quarter.

REAL ESTATE

ANDERSON, ZACHARY A., sales agent, Draper, Utah. On March 2, 2021, Mr. Anderson's license was placed on probation. In an order dated September 28, 2022, his license was reinstated and placed on probation for the renewal period due to a pending criminal charge. Case number RE-22-137917

ARMSTRONG, TRACY D., principal broker, Panguitch, Utah. In a stipulated order dated October 19, 2022, Mr. Armstrong admitted that he advertised the availability of property in a false, misleading, or deceptive manner and without the written consent of the property owner, in violation of Utah law and administrative rules. Mr. Armstrong stated that he had a decades-long friendship with a person who is the mother of the property owner and he relied on the mother's representations and signatures. Mr. Armstrong agreed to pay a civil penalty of $2,000 and to complete three hours of continuing education in addition to the continuing education required for his next license renewal. Case number RE-20-123276

ARREDONDO CASTRO, KEILA, sales agent, Riverdale, Utah. In an order dated November 29, 2022, Ms. Arrendondo Castro's license was renewed and placed on probation for the renewal period due to plea agreements she entered into during the past licensing period. Case number RE-22-139061

ASTIN, BEVERLY, sales agent, Sandy, Utah. In an order dated October 6, 2022, Ms. Astin's license was granted and placed on probation for the initial licensing period due to a plea in abeyance agreement in a criminal matter. Case number RE-22-138093

BANDLEY, STOCKTON DAVID, sales agent, Riverdale, Utah. In an order dated October 20, 2022, Mr. Bandley's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-22-138376

BARBER, KIMBERLY, sales agent, Kaysville, Utah. On October 13, 2022, the Division issued a citation to Ms. Barber for failing to respond to a request of the Division in an investigation within 10 days. The citation assessed a fine in the amount of $1,000. Citation # DREC-22-10, Case number RE-21-129797

COLEMAN, BRYAN, sales agent, Park City, Utah. In an order dated September 20, 2022, Mr. Coleman's license was granted, and placed on probation for the initial licensing period due to criminal history. Case number RE-22-137693

DERVISEVIC, ANEL, sales agent, West Jordan, Utah. In an order dated October 25, 2022, Mr. Dervisevic's license was renewed, and placed on probation for the renewal period due to criminal conduct during the past licensing period. Case number RE-22-138512

ESTRADA, RICK T., principal broker, West Jordan, Utah. On July 12, 2022, the Division issued a citation to Mr. Estrada for failing to respond to a request of the Division in an investigation within 10 days. The citation assessed a fine in the amount of $1,000. Citation # DREC-22-7, Case number RE-21-131845

FLUCKIGER, TERRY DUANE, principal broker, Herriman, Utah. In an order dated September 8, 2022, Mr. Fluckiger's license was renewed and placed on probation for the renewal period due to a plea agreement in a criminal matter during the past licensing period. Case number RE-22-137428

FRANCO, NATALIA, sales agent, West Jordan, Utah. In an order dated November 2, 2022, Ms. Franco's license was reinstated and placed on probation for the renewal period due to criminal conduct during the past licensing period. Case number RE-22-138711

GEHRING, IVAN, sales agent, American Fork, Utah. In an order dated September 16, 2022, Mr. Gehring's license was granted and placed on probation due to his failure to pay child support. Case number RE-22-137585

GLADWIN, WENDI KAY, sales agent, Bountiful, Utah. In an order dated November 30, 2022, Ms. Gladwin's license was renewed and placed on probation for the renewal period due to criminal conduct during the past licensing period. Case number RE-22-139063

HANSEN, IAN LUKE, sales agent, Vineyard, Utah. In an order dated October 21, 2022, Mr. Hansen's license was granted, and placed on probation for the initial licensing period due to criminal history. Case number RE-22-138404

HARTMAN, JAKE NICHOLAS, sales agent, South Ogden, Utah. In an order dated November 9, 2022, Mr. Hartman's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-22-138858

INGRAM, JERRY A., principal broker, Syracuse, Utah. In an order dated August 5, 2022, the Real Estate Commission found Mr. Ingram guilty of numerous violations involving several properties including: 1) advertising in a false, misleading, or deceptive manner; 2) acting for more than one party in a transaction without the informed consent of the parties; 3) being incompetent to act as a principal broker; 4) failing to disclose in writing the licensee's position as a principal in a transaction; 5) failing to obtain prior written power of attorney before signing or initialing a document on behalf of a principal; 6) acting as a limited agent in a transaction in which the licensee is a principal; and 7) advertising to sell or lease property without the written consent of the owners of the property. In total, considering the number of properties involved and the different types of violations, the Commission determined that Mr. Ingram committed 28 violations of Utah law or administrative rules. The Commission found as aggravating factors the number and seriousness of the violations and that Mr. Ingram had been previously sanctioned for advertising violations. As mitigating factors, the Commission found that Mr. Ingraham was cooperative and candid with the Commission, that the cases investigated by the Division were his own properties or properties he was working on for family members at their request, and that none of these family members or tenants complained of his conduct or actions. The Commission ordered that Mr. Ingram pay a civil penalty of $14,000 ($500 per violation) and complete nine hours of continuing education. In addition, Mr. Ingram's broker license was reduced to a sales agent license and his license placed on probation through the end of the next licensing period. Case number RE-21-124675 and Docket number RE-2021-019

JOHNSON, JILLIAN, sales agent, South Weber, Utah. On September 20, 2022, the Division issued a citation to Ms. Johnson for advertising two properties for lease without identifying her affiliated brokerage. The citation assessed a fine in the amount of $500. Citation # DREC-22-8, Case number RE-22-132165

KAYKEO, LEVITZ LONDON, sales agent, West Valley City, Utah. In an order dated October 12, 2022, Mr. Kaykeo's application for licensure was denied due to criminal history. Case number RE-22-138189

LARSON, DEREK C., sales agent, Washington, Utah. On May 28, 2020, Mr. Larson was issued a real estate sales agent license. His license expired May 31, 2022. In an order dated November 22, 2022, the Real Estate Commission granted Mr. Larson's application to reinstate his license and placed it on probation due to criminal conduct during the past licensing period. Case number RE-22-135930

LAW, KYLE, sales agent, Roy, Utah. In an order dated October 20, 2022, Mr. Law's license was granted, and placed on probation for the initial licensing period due to criminal history. Case number RE-22-137377

MAGEE, CHRISTOPHER, sales agent, Park City, Utah. In an order dated November 14, 2022, Mr. Magee's license was granted and immediately suspended due to a criminal investigation of Mr. Magee. Case number RE-22-138931

MATISSEN, BRETT, sales agent, Arvada, Colorado. In an order dated October 20, 2022, Mr. Matissen's license was granted, and placed on probation for the initial licensing period due to criminal history. Case number RE-22-138369

MERRILL, ROBERT DON, sales agent, Herriman, Utah. In an order dated June 7, 2022, Mr. Merrill's application for licensure was denied due to the facts surrounding the surrender of his physician's license in Utah, the surrender of his certificate of registration with the DEA, and a settlement agreement with the Nevada State Board of Osteopathic Medicine. Case number RE-22-135446

MORGAN, MICHAEL J., sales agent, Salt Lake City, Utah. In an order dated November 25, 2022, Mr. Morgan's license was reinstated, and placed on probation for the renewal period due to criminal history. Case number RE-22-139051

MURRAY, JOCELYN LEE, sales agent, Provo, Utah. In an order dated September 14, 2022, Ms. Murray's application to renew her license was denied due to criminal conduct during the past licensing period. Case number RE-22-137523

ORTLER, JAMES L., associate broker, Brian Head, Utah. In an order dated September 23, 2022, Mr. Ortler's license was renewed and immediately suspended while criminal charges against him are resolved. Case number RE-22-137766

PEART, WILLARD J., sales agent, Toquerville, Utah. In an order dated October 21, 2022, Mr. Peart's license was renewed and placed on probation for the renewal period due to criminal conduct during the past licensing period. Case number RE-22-138410

PINDER, MATTHEW, sales agent, South Jordan, Utah. In an order dated September 28, 2022, Mr. Pinder's application to renew his license was denied due to criminal conduct during the past licensing period. Case number RE-22-137864

RANKIN, TYLER J., sales agent, Salt Lake City, Utah. In an order dated September 13, 2022, Mr. Rankin's license was granted and placed on probation for the initial licensing period due to a plea agreement in a criminal matter. Case number RE-22-137519

SANCHEZ-CUFINO HERNANDO JOSE, sales agent, West Jordan, Utah. In an order dated October 12, 2022, Mr. Sanchez-Cufino's license was reinstated and placed on probation for the renewal period due to a plea in abeyance agreement in a criminal matter during the past licensing period. Case number RE-22-138192

SANDS, CHRIS, and SANDS INVESTMENT GROUP, unlicensed, Los Angeles, California. On September 20, 2022, the Division issued a citation to Mr. Sands and to Sands Investment Group for marketing properties for sale in Vernal, Utah, without a license. The citation assessed a fine in the amount of $1,000 and ordered that the parties cease and desist from engaging in the business of a principal broker in Utah unless or until they obtain a license to do so. Citation # DREC-22-9, Case number RE-22-133306

SAZESH, SIERRA, sales agent, Taylorsville, Utah. In an order dated November 25, 2022, Ms. Sazesh's license was reinstated and placed on probation for the renewal period due to criminal conduct during the past licensing period. Case number RE-22-139049

SLONE, PAMELA ANNA, sales agent, West Haven, Utah. In a stipulated order dated October 19, 2022, Ms. Slone admitted to a number of violations of Utah law and administrative rules from a series of cases. The violations include: 1) being incompetent to act as a sales agent in such a manner as to safeguard the interests of the public; 2) failing to respond to a request by the Division within 10 days; 3) failing to uphold fiduciary duties owed to a principal; 4) failing to hold safe and account for money or property entrusted to her; 5) failing to execute a written agency agreement with her principal; 6) failing to conform to accepted standards of the real estate property management industry; and 7) failing to conduct property management services under the name of the brokerage as registered with the Division. Ms. Slone worked in the property management industry with her then husband, Mr. Slone, who was not licensed with the Division. Mr. Slone was the sole owner of the real estate company. Another person was the principal broker for the company. Mr. Slone and the principal broker agreed that Mr. Slone would operate the property management portion of the business and the principal broker would operate the real estate sales portion of the business. Ms. Slone knew or should have known that Mr. Slone was unlicensed and did not have broker supervision. Following their divorce, Ms. Slone continued to work for the brokerage and knew that Mr. Slone was misusing funds from the brokerage trust accounts. She informed the principal broker of Mr. Slone's conduct. During this time, Ms. Slone accepted payments for alimony, child support, and income when she knew or should have known that the funds she received included money wrongfully taken from the trust accounts. Ms. Slone agreed to pay a civil penalty of $10,000, that her sales agent license should be revoked, and that she cease and desist from any conduct that requires a license with the Division. Case numbers RE-18-104141, RE-18-104123, RE-18-104883, RE-18-105316, RE-18-105484, and RE-18-105920

TAYLOR, JENNY LYNN, sales agent, Roosevelt, Utah. In an order dated September 22, 2022, the Real Estate Commission denied Ms. Taylor's application for licensure due to her criminal history and her failure to comply with court orders. Case number RE-22-134792

VALDEZ, ALAN ABDIEL, sales agent, West Valley City, Utah. In an order dated October 6, 2022, Mr. Velez's license was denied due to criminal history and failure to pay child support. Case number RE-22-138062

VELEZ, JARED, sales agent, North Logan, Utah. In an order dated November 1, 2022, Mr. Velez's license was reinstated and placed on probation for the renewal period due to criminal conduct during the past licensing period. Case number RE-22-138682

ZUMAETA, NICHOLAS HUGO, sales agent, Salt Lake City, Utah. In an order dated September 14, 2022, Mr. Zumaeta's application for licensure was denied due to criminal history. Case number RE-22-137526

TIMESHARE

There were no disciplinary or licensing actions in the mortgage industry in the fourth quarter.

Kagie's Korner — New Electronic Complaint Process

The Division would like to announce a new electronic complaint filing process. The Division has been using the same complaint filing and tracking process for over 19 years. The Division recently upgraded to an online software platform and now has the ability to accept and acknowledge receipt of complaints electronically. In November 2022, the Division went live with the new platform and will no longer be accepting paper complaints.

To file a complaint, go to Submit a Complaint page. The process starts with an introductory page informing the filer of the Division of Real Estate's regulatory jurisdiction, how the Division uses complaints to regulate licensees and investigate unlicensed persons, and then navigates the user through the complaint filing process. The new platform allows complainants to upload documents to support their allegations.

The navigation bar in the platform allows the complainant to see where they are in the process. The process mirrors the Division's complaint form and the input windows are as follows:

- Instructions: informs the complainant what they will need to fill out the complaint and instructs them to gather all relevant evidence.

- Your Information: the complainant provides their contact information. (This is very important as the Division may need to contact you for clarification or additional information. Not providing contact information may result in the decision to turn down and not investigate your complaint).

- Who are you complaining about: the complainant provides the name and contact information for the person(s) they are complaining about.

- Additional information: the property address involved in the matter, if applicable, and whether the complaint has been submitted to another government agency or an attorney.

- Complaint Description: allows the complainant to give a detailed description of the facts, circumstances, and timeline of the complaint.

- Provide Documents: allows the complainant to provide supporting documents, or explain why they cannot provide any documents to the Division.

- Declaration: includes the complainant's declaration that the provided information is true and correct. This section also includes the Division's notice that the complainant's cooperation with the investigation is necessary and that the complaint may become public.

Review: the complainant can review and edit their complaint, making sure the information they have provided is correct prior to submitting the complaint.

Once the complainant has reviewed their complaint and hits the submit button, the complaint is uploaded to the Division's new investigative platform. The Complainant will receive an emailed acknowledgment that the Division is in receipt of the complaint and its assigned case number.

It is important to replace old complaint forms with the new complaint link at: http://52.39.65.14/submit-a-complaint/

If you fax, mail, or email an old form, you will be asked to use the online form to submit your complaint.

The new electronic complaint form process will enable greater efficiency and transparency regarding the complaint process and the status of complaints.

Who's on Title?

Laurel North — Lead Investigator

For those of us who are adrenalin junkies, securing a listing is invigorating! It's the seller's signature inked on the bottom line that starts the burst of activity and opens the door to the possibilities of facilitating that "perfect" sale where everyone is satisfied, informed and timelines are met.

Of course, you were sure to verify that your seller's signature is, in fact, the authorized person to sell the property, right? Possible screeching halt!

Here are some ruminations for you to consider:

- Have you verified the identity of your seller(s)? Are they the owner of record?

- Have you researched who's on title at the county recorder or had a preliminary title report pulled from a title company to verify the recorded owners?

- Is the owner of record deceased? Is there a trust appointing a successor trustee? If the estate is in probate, has a personal representative been appointed by the court?

- Is the property owned by an LLC or Corporation and is the entity's name on the contract to reflect the recorded ownership? Are all the parties in the business operating agreement signing the contract or does one person have authority to bind the entity with only one signature?

- Are the names and signatures on your contracts legally binding that includes the verbiage of a successor trustee, personal representative, or managing member when necessary?

- When you have a personal interest in the property, are you cutting corners because everyone "understands verbally" who represents whom and who is the legal owner of the property?

Your head is probably spinning at the nuances of possible property ownership but we have seen all of these scenarios at the division and have sanctioned licensees for violating the following statutes and rules.

§61-2f-401 Grounds for disciplinary action

The following acts are unlawful and grounds for disciplinary action for a person licensed or required to be licensed under this chapter:

- Advertising the availability of real estate or the services of a licensee in a false, misleading, or deceptive manner

R162-2f-401b Prohibited Conduct As Applicable to All Licensed Individuals

- An individual licensee may not:

- Engage in any of the practices described in section 61-2f-401, whether acting as an agent or on the licensee’s own account in a manner that:

- Fails to conform with accepted standards of real estate sales, leasing, or management industries

- Could jeopardize the public health, safety, or welfare

- Place a sign on real property without the written consent of the property owner

- advertise or offer to sell or lease property without the written consent of:

- the owner(s) of the property

- Engage in any of the practices described in section 61-2f-401, whether acting as an agent or on the licensee’s own account in a manner that:

Let's play a quick game of Red Flag in answering some of the ruminations 1-6 listed above.

- If someone asks you to list a property but refuses to verify their identity – Red Flag . There are current instances of non-owners calling up random agents to try and get them to list a property they don't own. If you are unfamiliar with your clients, ask them to verify their identity.

- If you research the recorded documents on a property and your seller is not the owner of record – Red Flag . You need to list the property and contracts in the name of the owner of record with corresponding legal signatures.

- If you are asked to list a home that is going through probate but understand that a personal representative hasn't been appointed yet – Red Flag . You need to WAIT until a personal representative is appointed before you list the property or you have an invalid listing.

- If you are part of an LLC with full authority to sign on behalf of the trust, can you set up a listing in your own personal name – Red Flag . No, you can't. You need to list the property as being owned by the entity and use legal signatures that correspond with that entity.

- If a selling agent tells the buying agent that the correct names of record and legal signatures will be changed and updated on the closing paperwork at the title company – Red Flag . Make sure your contracts are legally valid before closing.

- At the Division, we frequently hear, especially from licensees selling their own properties, "everyone knew who was representing whom and who owned the property, everything was completely transparent" – Red Flag . Get verbal understandings and agreements in writing, get verbal understandings and agreements in writing, get verbal understandings and agreements in writing and get all parties to sign it.

Good agents get tripped up when shortcutting the initial stages of verifying property ownership because they want to hurry and not frustrate their new client with the very direct question of Who's on Title? Keep this in the back of your mind as you plow through the uncomfortable questions. Good clients understand and are willing to verify and share information about the ownership of the property they are asking you to sell for them. Good clients who are transparent about property ownership lay the foundation for your "perfect" sale where everyone is satisfied, informed and timelines are met.

Instructor Development Workshop 2022 Recap

The Division recently conducted its annual two-day Instructor Development Workshop for Real Estate, Mortgage, and Appraisal Instructors in Salt Lake City and it was an overall great success!

On the first day, attendees received updates from the Division. Director Jonathan Stewart opened the Workshop by presenting statutory and administrative rule changes from the past year. He also outlined new proposed items that the Division is working on including upcoming market research studies. Director Stewart also discussed topics relating to Trust Accounts, the Uniform Real Estate Contract, Broker Applicants and the Broker Experience Documentation Form just to name a few!

Attendees heard from our Chief Investigator, Kadee Wright, and our Lead Investigator, Laurel North. They discussed the FBI RAP Back Enrollment and the continued success of the program, new Core Topic subject additions as well as the new Real Estate 2023 Mandatory Course Outlines. Also presented was information regarding the Practical Applications of Real Estate Appraisal (PAREA) course modules, industry updates, and other Appraisal profession topics such as Equity, Bias, and Diversity. Chief Investigator Wright discussed enforcement statistics and shared additional insight on areas pertaining to enforcement concerns and significant actions that have been conducted and stipulated to over the course of the last year. This last portion always seems to be a crowd favorite!

Continuing Education and Licensing topics presented at the workshop included the recent changes to Education and Exam Waivers, how to handle expired courses, course renewals, and Instructor renewals. The Division also presented the exam evaluation process and results for the Pearson Vue Real Estate and Lending Manager Exam Reviews. In addition, Real Estate Schools, Instructors, and Course Providers were provided insight into how they can continue to improve the quality and overall information retention of their Continuing Education Instruction and class offerings.

Day two featured our guest speaker, Jim Fletemier who is a nationally recognized motivational humorist and instructional developer as well as a former residential Broker in North Carolina. Jim is the founder and Lead Curriculum Developer for E4 Education Development Services© (a B2B consultative instructor and curriculum development firm serving adult education and trainers worldwide) and the lead researcher on some current forward thinking in the field of Educational Psychology. Attendees experienced firsthand his passion and unique approach to teaching and participated in personal development and teaching exercises to further enhance their teaching abilities. The Division is grateful for the time and energy that Jim put into providing our attendees with not just a fun experience but also an amazing learning opportunity!

Here are just a few things some of our attendees had to say about their experience:

"Very good ideas for how to use stories as teaching concepts."

"Evoked an atmosphere of the universal interest in being a better instructor and becoming better at conveying information."

"Great info that is on our level."

"He was amazing!"

"Loved his engaging instructions and valuable workshop style. We all learned a lot of applicable skills and approaches."

"I like the added humor and personalization. It made the material memorable."

"Class involvement was good and instructor was entertaining."

"Fantastic!"

The Division would like to thank Mr. Fletemier for an outstanding presentation and would also like to thank all of the attendees that helped make this event such a success. If you weren't able to attend our Instructor Development Workshop this year, please keep in mind that this is an annual event that takes place every October and we would love to see you next year!

2023 Caravan Announcement

Attention! We are currently in the planning stages for our annual CARAVAN event and want to remind everyone to keep an eye out for future announcements! CARAVAN will be held in April and May this year. Look for email announcements with specific locations and dates. They will be sent out shortly. Licensees from each of the Real Estate, Appraisal, and *Mortgage professions are invited to attend any of the nine (we are bringing Park City back by popular demand), 3-hour CARAVAN sessions being held throughout the state (*Mortgage licensees will receive 1 hour of credit for attending the full course to fulfill their state-specific CE requirement).

Jonathan Stewart, Director of the Division of Real Estate, Kadee Wright Chief Investigator, and Mark Fagergren, Director of Licensing and Education will discuss current issues and hot topics facing the real estate, mortgage, and appraisal professions. They will also be available to answer questions or address concerns you may have as a licensee.

These events are FREE, however limited capacity necessitates a first come, first served electronic reservation system to save your seat. Once we have the dates and locations secure, information on how to register will be made available. The following dates and locations for these events are posted below, but please remember:

THESE ARE TENTATIVE DATES ONLY AND ARE SUBJECT TO CHANGE

Vernal — April 4, 2023

Provo — April 11, 2023

Layton — April 13, 2023

Park City — April 18, 2023

Logan — April 20, 2023

Moab — May 9, 2023

Richfield — May 10, 2023

Cedar City — May 11, 2022

St George — May 12, 2023

If you have any questions, please feel free to email Sandra at: sbargas@utah.gov. We look forward to seeing you all soon!

Vacant Land Fraud

The Division of Real Estate has recently learned of a new fraudulent scam. The scam usually includes vacant land that is free and clear. The fraudster pretends to be the owner of the vacant land and lists the property for sale, usually as a "FSBO", and usually well below market value. While many of these transactions were appearing on platforms like Zillow, we are now hearing that more of them are being listed with brokerages to get the listing on an MLS.

Sellers in these fraudulent transactions are either not in Utah, are pretending to be out of state, or are out of the country. These sellers usually communicate via email or text and want to close the transaction quickly. The sellers sign the deed and has it notarized. It is not clear whether the notary is involved in the fraud or if the sellers are presenting false identification.

Red Flags

- Involves vacant land (in rare circumstances, vacant condos);

- The seller is not in Utah, and may be out of the country;

- The seller will only sign documents remotely;

- The seller won't provide detailed information about the property. Typically, they are not able to provide information about Club Memberships, HOA dues, HOA transfer fees, utility charges, water rights, water shares, etc.;

- The vacant land is being listed for well below market value;

- The seller is in a big hurry to close; and,

- A seller isn't acting quite right.

Tips to Avoid a Land Selling Scam

- Research the name of the seller and check their photo ID

- Take additional steps to identify ownership of the land

- Ask specific questions about the property

- If you are contacted about selling vacant land or if you are representing a buyer who is looking at vacant land, please do your due diligence and be certain the sellers actually own the property.

To read the Division's full press release, please visit: Press Releases

Distributing Commissions — Title Companies

Over the last four to six months the Division has received several questions about Utah law and the proper distribution of commissions. We have been told that there are brokers who give verbal or written instructions to title companies to distribute commissions directly to sales agents by mailing them a check or by some form of electronic transfer to the sales agents' bank accounts. The law is very clear, that while a title company may be involved, the payment must be distributed by the principal broker.

61-2f-305. Restrictions on commissions.

- Except as provided in Subsection (2), an associate broker or sales agent may not accept valuable consideration for the performance of an act specified in this chapter from a person except the principal broker with whom the associate broker or sales agent is affiliated.

- An associate broker or sales agent may receive valuable consideration for the performance of an act specified in this chapter from a person other than the principal broker with whom the associate broker or sales agent is affiliated if:

- the valuable consideration is paid with a payment instrument prepared by a title insurance agent;

- the title insurance agent provides the payment instrument to the principal broker;

- the title insurance agent complies with the written instructions of the principal broker:

- in preparing the payment instrument; and

- delivering the payment instrument to the principal broker; and

- the principal broker directly delivers the payment instrument to the associate broker or sales agent.

While the statute does allow a title insurance agent to prepare a payment instrument, brokers may not delegate the distribution of the commission instrument to a title company. Commission instruments need to be delivered to the principal broker who then delivers them to the associate broker or sales agent.

If you are a principal broker, please ensure that your commission distribution policies and procedures adhere to state law.

Credits

Director: Jonathan Stewart

Editor/Contributor: Mark Fagergren

Contributor/Layout: Sandra Bargas

Contributor/Layout: Lark Martinez

Contributor: Kadee Wright

Contributor: Justin Barney

Contributor: Van Kagie

Contributor: Laurel North

Webmaster: Jason Back

2022 Published by

Utah Division of Real Estate

Department of Commerce

160 E 300 S

PO Box 146711

SLC UT 84114

(801) 530-6747

Real Estate Commissioners

James Bringhurst, Chair

Randy Smith, Vice Chair

Marie McClelland

Rick Southwick

Andrea Wilson

Mortgage Commissioners

Jeff England, Chair

G. Scott Gibson, Vice Chair

Kay R. Ashton

Allison Olsen

George P. Richards

Appraiser Licensing and Certification Board Members

Jeffrey T. Morley, Chair

Keven Ewell, Vice Chair

Ben Brown

Kris Poulson

Richard Sloan

Kelle Smart