Newsletters

2nd Quarter 2021 Real Estate Newsletter

In this issue:

- Director's Message – Review of all Regulated Occupations and Professions

- RAP Back Fingerprinting Resumes

- New Division Website

- Rule Developments Since March 1, 2020

- New License Data and Current Licensing Statistics

- Violations Summary from 2020

- Kagie's Korner – Fiduciary Duty to Your Clients

- Farewell to Commissioners

- Division Staff Spotlight — Sydney Joy

- ASB USPAP Extension

- Mortgage 5 Hour Course

- Second Quarter Licensing & Disciplinary Actions

- Instructor Development Workshop Registration

- Credits

Director's Message – Review of All Regulated Occupations and Professions

On January 4, 2021, in their first official action in office, Governor Cox and Lt. Governor Henderson signed an executive order directed to all Executive Branch agencies that establish administrative rules or other regulations for an occupational or professional license. The executive order required all of these agencies to:

review administrative rules and other regulations for occupational or professional licenses within the agency's scope of authority and identify rules and regulations that are no longer necessary or can be amended to reduce barriers to working while still protecting the health, safety, and well-being of Utah residents.

In addition to the review, all agencies were required to submit a report to the Governor's Office, no later than June 30th, outlining recommendations.

Since January, Division staff performed an extensive review of all statutes and rules flagging anything that appeared to be a barrier to entry or an unreasonable regulation. We then prioritized all flagged sections in the following way:

- Must Review

- Should Review

- Could Review

- Would like to Review

We have taken a closer look at all flagged items in the first two categories, and are considering the following statutory and administrative rule changes:

Real Estate

Statutory

61-2f-402(5)(a) – If a person is found to have violated this chapter, the person shall pay the costs incurred by the division.

We have never charged a licensee for costs incurred during an investigation. We are proposing to remove this section.

61-2f-402(5)(b) – If a person fails to pay the costs outlined in 61-2f-402(5)(a), their license is suspended.

Because we have never charged a licensee for costs incurred during an investigation, it is not necessary to have a provision that would suspend a license for failure to pay. We are proposing removing this section.

61-2f-207(2) – The division may charge a fee established by the commission with the concurrence of the division...for processing any notification of change submitted by an applicant, licensee, registrant, or certificate holder.

The division does not charge these fees and we are proposing removing this section.

61-2f-204(1)(e)(ii) – A licensee is immediately and automatically revoked if the criminal background check discloses the applicant fails to accurately disclose a criminal history involving:

- The real estate industry

- A felony conviction on the basis of an allegation of fraud, misrepresentation, or deceit.

We are proposing removing the provision about automatic revocation and giving the Division and Commission discretion.

Administrative Rule

R162-2f-401l – This is the Gifts and Inducements section of Administrative Rule.

The Division and Commission do not have rulemaking authority for this section. We are proposing adding rulemaking authority in the 2022 legislative session.

R162-2f-105 ” Any fee collected by the division is nonrefundable.

In statute it states that application fees are nonrefundable. Section 105 goes beyond what is in statute and there are "isolated instances" when the Division refunds fees. We are proposing to remove this reference.

R162-2f-202d – Requires a licensee to pay a fee to add a property management sales agent designation and a fee to remove the designation.

We are proposing removing the requirement to pay a fee to remove the designation.

R162-2f-202b(5)(c) – This section is about property management principal broker license, which the division ceased issuing May 8, 2013.

We are proposing removing this section.

Appraisal

Administrative Rule

R162-2g-310(4) – The board may not issue a license or certification to an applicant who has been convicted of a criminal offense involving moral turpitude relating to the applicant's ability to provide services as an appraiser.

During the 2020 Legislative Session, we removed several references to crimes of moral turpitude, as it is a subjective term. We plan to remove this reference as well.

Appraisal Management

Statutory

61-2e-401(2)(a) – If a person is found to have violated this chapter…the person shall pay the costs incurred by the division.

Similar to 61-2f-402(5)(a) referenced above. We have never charged an appraisal management company for the costs incurred during an investigation. We are proposing removing this section.

Mortgage

Statutory

61-2c-203(1)(b) – requires an applicant to demonstrate good moral character.

This is an ambiguous term, and not defined in statute. We are proposing removing this reference.

61-2c-402 – According to the SAFE Act, if a mortgage license is revoked it is a lifetime revocation unless the revocation is formally vacated. Utah Law does not allow for the vacation of a revocation.

We are proposing adding a provision to allow for a mortgage licensee whose license was revoked, to have the revocation potentially vacated after a hearing in front of the Mortgage Commission and certain conditions or requirements are met.

61-2c-202(1)(c)(ii) – pay the division:

- An application fee established by the division...; and

- The reasonable expenses incurred by the division in processing the application for licensure.

We have never charged a mortgage applicant more than the application fee. We are proposing removing reference to the reasonable expenses incurred by the division.

Administrative Rule

R162-2c-201(1)(a)(i) – To obtain a Utah license to practice as a mortgage loan originator, an individual who is not currently and validly licensed in any state shall:

- Evidence good moral character.

Similar to previously referenced provisions, good moral character is an ambiguous term. We plan to work with the Commission to remove this reference.

R162-2c-202(1) – Individual applicants and control persons shall evidence good moral character, honesty, integrity, and truthfulness.

Once again, we plan to work with the Commission to remove the ambiguous reference to good moral character.

R162-2c-202(1)(a)(i)(C)(I) – An applicant may not have…a misdemeanor involving moral turpitude.

As previously mentioned, during the 2020 Legislative Session, we removed several references to moral turpitude in statute. We plan to remove references in administrative rule as well, as this term is subjective.

R162-2c-203(6)(h)(ii)(A) – To renew an instructor certification for Utah-specific prelicensing education, an applicant shall submit to the division:

- Evidence of having taught at least 20 hours of classroom instruction in a certified mortgage education course during the preceding two years.

With a significant amount of education moving to virtual platforms, we plan to work with the Commission to amend this rule to allow the 20 hours to also be obtained via virtual learning platforms.

R162-2c-301b – During the 2020 Legislative Session, the rulemaking authority for the Employee Incentive Program was removed as part of another amendment.

We plan to work with the Commission to remove this section in its entirety.

We will continue to review flagged items in the "Could Review" and "Would Like to Review" categories, which could lead to additional proposed amendments. In addition to this review process, the Department is looking at developing a systematic way to periodically review regulations. We have appreciated the opportunity to take a closer look at our statutes and rules and believe that a periodic review is important in maintaining relevant and reasonable regulations.

RAP Back Fingerprinting Resumes

As mentioned in our 1st Quarter Newsletter, fingerprinting for RAP Back would most likely return for those renewing in July. Those renewing in July should have already received their renewal notices, notifying them that fingerprinting will be required in order to renew.

This article contains the most up-to-date and important information about RAP Back fingerprinting. Division staff have been extremely busy with the continued increase in licensing numbers. Please read the entire article before calling the Division. We are always happy to assist if you have specific questions that have not been answered in this article.

In an effort to help all licensees avoid any delays in license renewal, these are the most common questions we receive about RAP Back and license renewal:

- What is Rap Back?

"The Rap Back service allows authorized agencies to receive notification of activity on individuals who hold positions of trust (e.g. school teachers, daycare workers [and now real estate and appraisal licensees]), thus eliminating the need for recurring background checks on a person from the same applicant agency..." (https://www.fbi.gov/services/cjis/fingerprints-and-other-biometrics/ngi )

- Who has to be fingerprinted?

S.B. 140 from the 2019 Utah Legislative Session requires all active and inactive real estate agents, brokers, and all appraisers to be fingerprinted and enrolled in RAP Back.

- What is the cost?

The Bureau of Criminal Identification ("BCI") charges $40 for processing fingerprints and $5 to enroll a licensee in RAP Back. Third Party fees: Depending on where you get fingerprinted, there may be additional fees.

- When should licensees be fingerprinted?

Licensees should be fingerprinted in their renewal window*. Appraisers have a renewal window of three months before expiration and real estate licensees have a renewal window of 45 days prior to expiration. *Because of the complexity of RAP Back, July renewals had a shorter renewal window.

- Why do licensees need to wait until their renewal window to be fingerprinted?

As mentioned above, the fee for fingerprint processing and RAP Back enrollment is $45. When a licensee's fingerprints are submitted to BCI, BCI bills the Division the $45. A licensee will not pay the $45 until they renew their license. The Division needs to collect the funds from licensees to pay BCI for the processing of fingerprints and enrollment in RAP Back.

- Where can licensees be fingerprinted?

The Division of Real Estate has tried to make it as convenient as possible for licensees to be fingerprinted. During the process detailed in number 7 below, licensees will be given a list of fingerprinting locations. Please select one of the locations to have your fingerprints taken. If you select the Division, please keep in mind that while the Division does offer fingerprinting services, we do so by appointment only and require licensees to wear a mask. Please schedule your appointment on the Division's website before arriving at the Division. Remember that there are numerous other locations that offer fingerprinting services including most police stations.

- What do you need to do prior to being fingerprinted?

- To renew their license, each Real Estate and Appraisal licensee must visit the RAP Back page on the Division's website: http://52.39.65.14/rapback/ to review and sign a Consent to Background Check Form. This will all be done electronically and licensees will have the ability to print a copy of the completed form for their own records.

- After, and only after the licensee reviews and electronically signs the consent form, will they have access to the Authorization for Direct Electronic Submission Form that licensees are required to take with them to be fingerprinted. The form requires you to enter specific information that must be presented to your fingerprint vendor. Only forms with electronically entered licensee information should be provided to your fingerprint vendor (hand written information on the form is prohibited). Please do not make copies of this authorization form for other licensees; the FBI requires that each licensee sign the consent form. Failure to review and sign the consent form on the Division’s website would likely prevent you from being able to be fingerprinted and renew your license.

- The Consent to Background Check form and the Authorization for Direct Electronic Submission Form can be found on the Division website at (http://52.39.65.14/rapback/). The system will only let you proceed when you are authorized to be fingerprinted (based on information found in Question 4 above).

- What should you take with you when being fingerprinted?

- A copy of your license, or at least your license number, as you must submit your license number with your fingerprints;

- Valid driver’s license or passport; and,

- The Authorization for Direct Electronic Submission Form that you can print on our website once you have completed the Consent to Background Check Form. Print the completed authorization form and bring the form with you when you are fingerprinted. If you do not have all the requested information on the authorization form, you may not be fingerprinted, or your background check may not properly link to your license, which could delay your license renewal.

- What is the timeframe after being fingerprinted?

If you are fingerprinted using Direct Electronic Submission the processing time is typically up to 5 days. If you are fingerprinted using paper fingerprint cards (Two Original FD-258 Fingerprint Cards) it can take 15-30 days to process. Keep this in mind when deciding when and where to be fingerprinted. If you know you will be using a location that only does paper fingerprint cards, plan accordingly.

You will be prevented from renewing your license until the RELMS system receives an electronic acknowledgement from the Utah Bureau of Criminal Identification (BCI) that you have submitted your fingerprints to the FBI for processing, you have no criminal history, or the Division has reviewed your criminal history.

- What should you do with fingerprint cards?

Most Direct Electronic Submission locations will still print off a fingerprint card for your records. The only time you need to send the fingerprint cards to the Division is if your fingerprints were not electronically submitted to BCI. If you are unsure, please ask the third-party provider if your fingerprints have been direct electronically submitted to BCI. If they have been electronically submitted to BCI, you may retain the cards for your own records. If they have not been submitted electronically to BCI, you may send the printed fingerprint cards (Two Original FD-258 Cards) along with the Fingerprint Card Submission Form to the Division and we will submit the cards electronically to BCI.

- What about Dual Brokers?

Dual Brokers only need to be fingerprinted for their principal broker license.

- What about those holding another license?

If you are a real estate agent and appraiser, you must be fingerprinted for each license type you hold. In addition, if you are already enrolled in RAP Back because you have been enrolled for another reason, you still must be fingerprinted and enrolled for each license you have with the Division. The FBI requires separate enrollment for each license type.

- Do licensees have to be fingerprinted again?

Once you are enrolled in RAP Back you will stay enrolled as long as you maintain your license and renew on time. Allowing your license to expire may result in removal from the RAP Back system requiring you to resubmit to a background check.

I hope this gives you a better understanding of what RAP Back is and what to expect the next time you renew your license. I know this is an inconvenience, but hope that you all see the value this will add to your industry.

New Division Website

For several months the Division of Real Estate has been working on a new website: http://52.39.65.14. Several industry members assisted in testing during the development stage and we appreciate all their time and feedback. As with any new website, there will be glitches or things we have overlooked. Please explore our new website and send any feedback you have to realestate@utah.gov. Thanks!

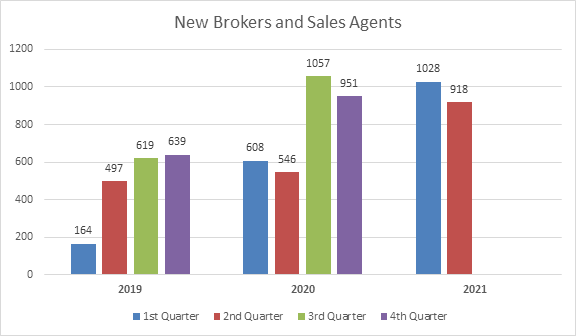

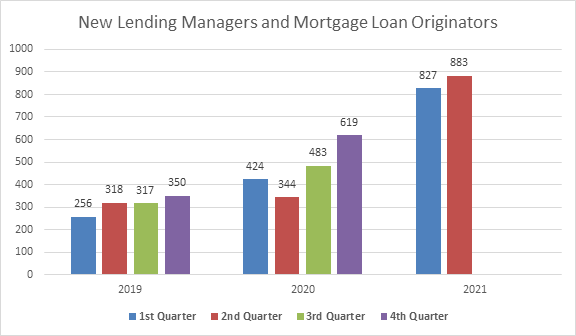

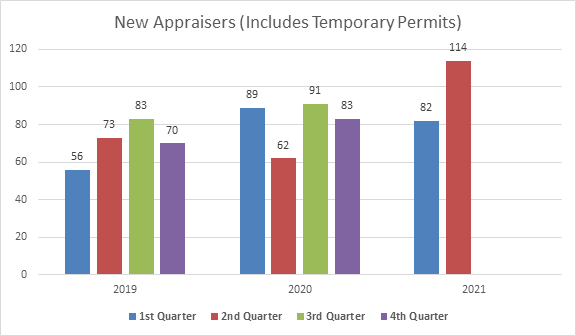

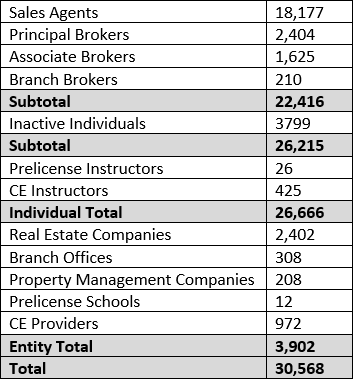

New License Data and Current Licensing Statistics

The Division of Real Estate continues to see an increase in new applications. Here is a look at new applicant data from 2019 through the end of 2nd Quarter 2021, as well the overall licensing statistics for all industries.

Current Real Estate Licensing Numbers

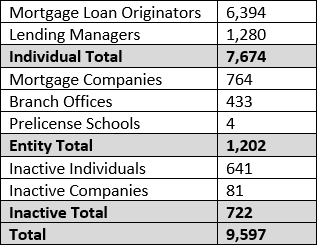

Current Mortgage Licensing Numbers

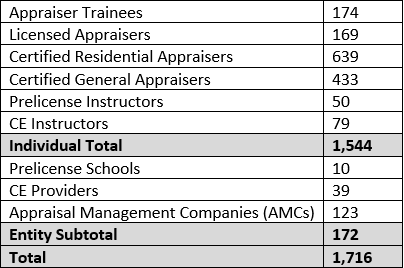

Current Appraisal Licensing Numbers

Violations Summary for 2020

by Laurel North – Lead Investigator

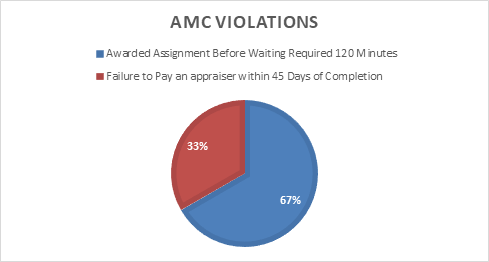

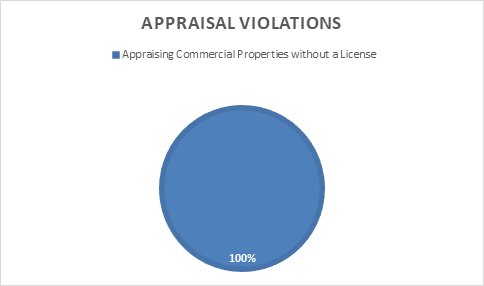

Here's a compiled pie chart primer for each industry of the Disciplinary Actions included in the Division of Real Estate Newsletters in 2020. Hopefully, it's a quick and easy refresher to help you master the potential pitfalls that could hinder your business license.

AMC Violations. The categories are self-explanatory as you view the AMC Violations pie chart.

Appraisal Violations. If you have agreed to appraise a mixed-use residential/commercial building, or land where the highest and best use of the land exceeds a one-to-four residential unit use, you need to have a Certified General Appraiser License or the assistance of a Certified General Appraiser to fulfil the commercial aspect of the appraisal.

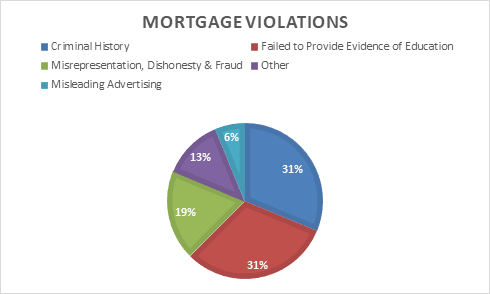

Mortgage Violations. The Criminal History Violations include applicants with a criminal history as well as those who hold a current license. The penalties for applicants range from denial of an application to license granted on suspension and/or probation. The penalties for current licensees range from revocation, suspension, and/or probation, and potential fines. The "Other" category includes violations in advertising, non-disclosure of hidden payments or fees, falsified documents, and unlicensed activity. All other categories are self-explanatory.

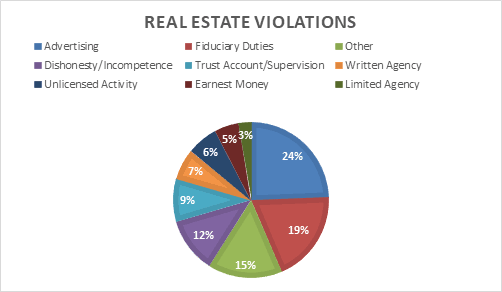

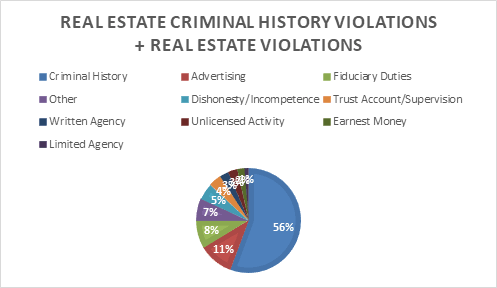

The Real Estate Criminal History Violations are not included in the Real Estate Violations pie chart because those statistics deeply skew the other categories. Below, you will see the heavy toll that Criminal History is taking on both applicants and current licensees. The penalties for applicants range from denial of an application, license granted on suspension and/or probation. The penalties on current licensees range from revocation, suspension, and/or probation, and possible fines.

Kagie's Korner — Fiduciary Duty to Your Clients

In today's extremely hot real estate market, many buyers are submitting offers that contain terms and language which could potentially place them at financial risk or actually harm them. The Division would like to remind all real estate licensees the importance of informing clients of their options and potential ramifications they might incur when entering into legally binding, yet potentially unsafe, if not precarious, Real Estate Purchase Contracts. Here are just a few representative examples:

- Agent Speedy has a client that viewed a house that just went on the market. The buyer is excited and wants to make an offer that the seller cannot refuse. Agent Speedy includes in the offer that the $30,000 earnest money will be nonrefundable upon acceptance and fails to thoroughly explain to his client what that means. When the buyer asks, Agent Speedy replies that it is what the client needs to do to get their offer accepted. The seller accepts the offer, and the client is very happy. A few weeks later the buyer's loan officer tells the buyer that they cannot qualify for a loan. The client goes to Agent Speedy prior to the finance deadline and tells him to cancel the contract due to financing conditions not being agreeable to the client. The client is shocked and dismayed when Agent Speedy reluctantly informs them that they will not be getting their earnest money back due to the fact that it became nonrefundable upon acceptance.

- Agent Lax submits an offer for a buyer that includes the buyer waiving the due diligence condition in the REPC, hoping to induce the seller to accept the offer. The seller accepts the offer and fails to disclose a serious known defect with the property. The buyer does not perform any due diligence inspections or testing because they cannot cancel the contract using the due diligence condition. The transaction closes and while moving into the home, a neighbor asks if "…they were aware that the seller went to jail for cooking meth on the property." The client immediately gets the property tested for meth only to find that it is heavily contaminated.

- Agent Quick, finds a seller and puts their home on the market. Within the hour, the seller accepts an offer which contains no contingencies. The sellers ask Agent Quick to help them find a new home and they have two months to move out. They spend every day for a month and a half looking for a new home without securing a suitable replacement home or placing another property under contract. The Seller desperately asks Agent Quick if they can cancel the contract and just stay were they are. Agent Quick informs the sellers that if they default the buyer can sue for specific performance on the binding contract.

- Agent Many has a listing, the property just went on the market yesterday and by 5:00 pm this afternoon received 53 offers. Agent Many is concerned that the seller would be over whelmed by the multiple offers, she therefore presents "what she believes" are the three "best offers" to the seller, and does not mention the other fifty. After going under contract, the seller is contacted by an old friend to see if they received their offer. The seller asks Agent Many about the friend's offer and why it was not presented. Agent Many informs the seller that she only presented three offers.

Agents, your fiduciary duties include looking out for your client's best interests. In fulfilling your fiduciary duties, you should explain and work to ensure that your client understands the potential risks (as well as the benefits) so they can make knowledgeable and well-informed decisions. Failing to help a client understand the ramifications of their decisions could place you in violation of one or more of the following statutes:

61-2f-401 (1) (e) making a false representation or promise of a character likely to influence, persuade, or induce;

61-2f-401 (7) being incompetent to act as a principal broker, associate broker, or sales agent in such manner as to safeguard the interests of the public;

61-2f-401 (15) breaching a fiduciary duty owed by a licensee to the licensee's principal in a real estate transaction;

Please use great care and diligence in helping your clients make complete and informed decisions as to what terms and conditions they are offering or accepting in a purchase contract. The Division suggests asking your broker for help when faced with multiple offers or when the transaction becomes more complicated than usual. Avoid having a complaint filed against you by being one of the agents cited in the above examples. Take good care of your clients and look out for their best interests.

Farewell to Commissioners

The Division would like to bid farewell to some amazing commissioners, whose terms are coming to an end:

Real Estate Commissioner

Lori Chapman

Served 7/1/2013 to 7/1/2021

Mortgage Commissioner

Cathy J. Gardner

Served 9/1/2013 to 7/1/2021

We would like to thank these outstanding individuals for their dedicated service to better our industry. Their wisdom has been an asset over the past eight years and they will be greatly missed.

Division Staff Spotlight

Meet Sydney Joy! Sydney has been employed with the Division for six months. She was originally hired as our receptionist, but has now taken on the role of Appraiser Licensing Specialist. Sydney finds her colleagues to be her favorite part of working at the Division. She states, "They're fun, smart, and wonderful people, who make this a good place to be." (We didn't pay her to say that...promise!)

Prior to her employment at the Division, Sydney graduated college with a Bachelors of Fine Arts in Ballet. She feels that her time spent studying ballet taught her a strong work ethic and gave her the ability to adapt to many situations.

Sydney is artistic and enjoys the beauty of many art forms. She spent time working at a local yarn store where she learned the art of knitting. In her spare time you will most likely find her listening to a podcast while knitting a sweater or sewing clothes. She also has a strange talent for memorizing song lyrics. She generally only needs to hear a song a few times and then she says, "It is stuck in my brain forever."

Though separated by distance, Sydney is very close to her family. She grew up in Napa, California, where her parents still reside. Her father is the sixth generation of her family to grow grapes, continuing a tradition that started back in Sicily.

The Division is lucky to have Sydney on our team. She is very bright and has performed exceptionally well in everything she has been tasked with.

Sydney Joy

ASB USPAP Extension

The Appraisal Standards Board (ASB) announced the extension of the current edition of the Uniform Standards of Professional Appraisal Practice (USPAP) by one year. The 2020 – 2021 USPAP will now be effective until December 31, 2022.

The ASB Chair (Wayne Miller) made the following statement following the USPAP extension announcement:

"“...Pressing issues have arisen in our profession over the past year ranging widely from concerns about fair housing matters to how to conduct a socially distanced property inspection. USPAP is a maturing document, and it can take longer to study the complex issues facing our profession and how they will impact our standards. We believe all of these are all critical issues and deserve thoughtful consideration before we issue guidance. With that in mind, we have decided to extend the effective date of the current USPAP one year. This will provide continuity to the profession during this pandemic while also giving the ASB the appropriate time to carefully examine the challenges facing our profession before offering additional guidance."

Since 2003 every appraiser has been required to "successfully complete the 7-hour National USPAP Update Course, or its AQB-approved equivalent, every two calendar years." The requirement to take the 7-hour course is not tied to the effective date or length of the effective dates of the current edition of USPAP. Extending the effective date of USPAP is an ASB decision, and it has no bearing on the AQB requirement for the 7-hour course.

If I took a 7-hour USPAP course last year, I am due to take the course again next year? Will the 2022 course be the same one that was offered in 2020 – 2021?

"No. A new 2022–2023 7-Hour National USPAP Update Course is currently being written and will be released on October 1, 2021 (and will be available to students shortly thereafter)."

The 2022 – 2023 7-Hour USPAP Update Course does not contain the same course materials as the 2020–2021 course.

Copyright © 2020 The Appraisal Foundation

Mortgage 5 Hour Course

Mortgage loan originators who were or will be either initially licensed or relicensed in Utah between 11/01/2020 to 10/31/2021 are required to complete the 5-Hour Utah MLO CE Course by October 21, 2021 for a timely renewal when the renewal period commences on November 1st. If an MLO has not completed the course by Oct 21, 2021 they will be prevented from renewing until the course is completed and the hours have been banked on the NMLS.

MLOs who still need to complete the course can find providers for this course on the Division's Website or on the NMLS website. To verify course completion, please check your Course Completion and Compliance Record on the NMLS by logging in to the NMLS , then click on the Composite View tab, then click on View Individual on the top sub-menu, then click on View Education Record on the left navigation panel. Approved course providers have seven (7) calendar days to bank a student's hours on the NMLS.

Second Quarter Licensing & Disciplinary Actions

Please note that Utah law allows 30 days for appeal of an order. Some of the actions below might be subject to this appeal right or currently under appeal.

To view a copy of an order referenced in this article please visit the Utah Division of Real Estate Disciplinary Actions Search at: http://52.39.65.14/licensing-and-disciplinary-actions/

APPRAISAL/AMC

There were no disciplinary or licensing actions in the appraisal or AMC industries in the fourth quarter.

MORTGAGE

CUMMINGS, NATHAN, mortgage loan originator, Pleasant Grove, Utah. In an order dated April 8, 2021, the Utah Residential Mortgage Regulatory Commission granted Mr. Cummings a license to practice as a mortgage loan originator. The license was placed on probation for the initial licensing period due to criminal history. Case number MG-2021-002

POSTAK, DANIEL JAY, mortgage loan originator, Phoenix, Arizona. In an order dated May 21, 2021, Mr. Postak's application for licensure was denied due to findings entered by the Nebraska Department of Banking and Finance that in his application for licensure in Nebraska he had made misrepresentations which reflected negatively on his good moral character, integrity, and competence. Case number MG-21-127199

REAL ESTATE

ABPLANALP, TAWSON SCOTT, sales agent, South Jordan, Utah. In an order dated March 18, 2021, Mr. Abplanalp's license was granted and placed on probation for one year due to a plea in abeyance agreement in a criminal matter. Case number RE-21-125744

ABU-SAFIJE, MERIJAM, sales agent, West Valley City, Utah. In an order dated March 3, 2021, Ms. Abu-Safije's license was granted and immediately suspended for 30 days for failing to disclose criminal history in her application for licensure. Following the 30-day suspension, Ms. Abu-safije's license will be on probation for the remainder of the initial licensing period. Case number RE-21-125410

ADULOVIC, TEA, sales agent, West Valley City, Utah. In an order dated April 27, 2021, Ms. Adulovic's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-21-126656

ALMEIDA-COLOM, RAFAEL, sales agent, Provo, Utah. In an order dated March 31, 2021, Mr. Almeida-Colom's license was renewed and placed on probation for the renewal period due to a plea in abeyance agreement in a criminal matter. Case number RE-21-126031

ANDERSON, TYLER JAMES, sales agent, Salt Lake City, Utah. In an order dated April 7, 2021, Mr. Anderson's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-21-126146

ANDERSON, ZACHARY A., sales agent, Draper, Utah. In an order dated March 3, 2021, Mr. Anderson's license was reinstated and placed on probation for the renewal period due to criminal conduct during the past licensing period. Case number RE-21-125398

BECKSTEAD, PAUL WESLEY, sales agent, Salt Lake City, Utah. In an order dated May 27, 2021, Mr. Beckstead's license was granted and placed on probation for the initial licensing period due to criminal history and unpaid child support. Case number RE-21-127374

BLANCHARD, BREVAN CRAIG, sales agent, Millville, Utah. In an order dated May 4, 2021, Mr. Blanchard's license was granted and placed on probation for one year due to a plea in abeyance agreement in a criminal matter. Case number RE-21-126811

BOLLOW, RUSSELL P., sales agent, Salt Lake City, Utah. In an order dated March 19, 2021, Mr. Bollow's license was renewed and placed on probation for the renewal period due to a pending criminal matter. Case number RE-21-125778

CONGRAM, DANIEL P., sales agent, Salt Lake City, Utah. In an order dated March 26, 2021, Mr. Congram's license was renewed and placed on probation for one year due to a plea in abeyance agreement in a criminal matter. Case number RE-21-125929

ESPARZA, ANTHONY ALEXANDER, sales agent, South Jordan, Utah. In an order dated May 5, 2021, Mr. Esparza's license was renewed and placed on probation for the renewal period due to criminal conduct during the past licensing period. Case number RE-21-126861

HARDEY, SCOTT D., associate broker, West Jordan, Utah. In a stipulated order dated March 17, 2021, Mr. Hardy admitted that he conducted business through an entity without first registering the entity with the Division, in violation of Utah law and administrative rules. Mr. Hardey agreed to pay a civil penalty of $6,000 and to complete three hours of continuing education in addition to the continuing education required for his next license renewal. Case number RE-17-91462 and Docket number RE-2021-001

HART, DONALD T., sales agent, Park City, Utah. In an order dated May 27, 2021, Mr. Hart's license was renewed and placed on probation for the renewal period due to a pending criminal matter. Case number RE-21-127393

HOGEWONING, CHRISTINA, sales agent, South Jordan, Utah. In an order dated May 5, 2021, Ms. Hogewoning's license was granted and placed on probation for one year due to criminal history. Case number RE-21-126865

HOLMAN, SAMUEL, sales agent, Salt Lake City, Utah. In an order dated March 19, 2021, Mr. Holman's license was renewed and placed on probation for the renewal period due to a pending criminal matter. Case number RE-21-125776

HOLMES, JULIE A., sales agent, South Jordan, Utah. In a stipulated order dated April 21, 2021, Ms. Holmes admitted that she violated her fiduciary duty of loyalty to her client when she placed her own interest above the interests of her client. Ms. Holmes discussed "partnering" with her client to purchase a property for resale. They agreed to move forward with the purchase but Ms. Holmes then began arranging to purchase the property with her cousin. Ms. Holmes signed an addendum terminating the Buyer-Broker agreement because she said she would be making an offer on the property herself. Ms. Holmes's actions were in violation of Utah law and administrative rules. She agreed to pay a civil penalty of $4,500, to complete six hours of continuing education in addition to the continuing education required for her next license renewal, and that her license would be placed on probation until April 30, 2023. Case number RE-17-96497

JOHNSON, AUBREN M., sales agent, Farmington, Utah. In an order dated March 17, 2021, Ms. Johnson's license was renewed and placed on probation for the renewal period due to a pending criminal matter. Case number RE-21-125739

KIFER, MERVIN, sales agent, Draper, Utah. In an order dated March 31, 2021, Mr. Kifer's license was renewed and placed on probation for the renewal period due to a pending criminal matter. Case number RE-21-126029

KIOA, SUSANNA MARGARITTA, sales agent, Salt Lake City, Utah. In an order dated March 18, 2021, Ms. Kioa's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-21-125747

MALECEK, JAMES, sales agent, Kamas, Utah. In an order dated April 27, 2021, the Real Estate Commission granted Mr. Malecek a license to practice as a real estate sales agent and placed his license on probation for the initial licensing period due to criminal history. Case number RE-21-125671 and Docket number RE-2021-005

MORA, MIA, sales agent, Salt Lake City, Utah. In an order dated May 12, 2021, Ms. Mora's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-21-126999

MORGAN, BRENT ALLEN, sales agent, South Jordan, Utah. On June 19, 2015, the Real Estate Commission entered an order suspending Mr. Morgan's real estate sales agent license due to a matter then pending with the Utah Division of Securities ("Securities"). On September 22, 2015, Securities entered an order which found Mr. Morgan had violated the Securities Act and ordered a civil penalty. In 2017 and 2019 Mr. Morgan's real estate sales agent license was renewed on suspension. Mr. Morgan recently paid the civil penalty to Securities and requested that his real estate sales agent license be renewed and the suspension lifted. In a stipulated order dated May 19, 2021, the Commission ordered, and Mr. Morgan agreed, that his real estate sales agent license would be renewed on probation for the renewal licensing period, effectively lifting the suspension of his license and allowing him to again practice as a licensed real estate sales agent. Case number RE-21-126454

MOYNIER, KASEY, sales agent, Salt Lake City, Utah. In an order dated March 12, 2021, Mr. Moynier's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-21-125592

NAYLOR, KEVIN MICHAEL, sales agent, Farmington, Utah. In an order dated May 4, 2021, Mr. Naylor's license was renewed and placed on probation for the renewal period due to a pending criminal matter. Case number RE-21-126807

NOWELL, CODY D., sales agent, Herriman, Utah. In an order dated March 30, 2021, Mr. Nowell's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-21-125983

OCONNOR, DAVID, sales agent, Midvale, Utah. In an order dated April 23, 2021, Mr. Oconnor's license was renewed and placed on probation for the renewal period due to a pending criminal matter. Case number RE-21-126600

REYNOLDS, AMANDA, sales agent, Sandy, Utah. In an order dated April 16, 2021, Ms. Reynolds's license was granted and placed on probation due to a pending criminal matter. Case number RE-21-126409

RICHMOND, JENNINGS, sales agent, Bluffdale, Utah. In an order dated March 18, 2021, Mr. Richmond's license was granted and immediately suspended. Mr. Richmond is certified as a peace officer and his peace officer certification is currently suspended. The real estate license is suspended until his peace officer certification is no longer suspended. Case number RE-21-125768

ROVIRA, SHELLY D., sales agent, West Haven, Utah. In an order dated March 12, 2021, Ms. Rovira's license was renewed and placed on probation for the renewal period due to a pending criminal matter. Case number RE-21-125591

SCHILLEMAN, SUMMER, sales agent, Farmington, Utah. In an order dated May 11, 2021, Ms. Schilleman's license was granted and placed on probation for the initial licensing period due to criminal history. Case number RE-21-126974

SULLIVAN, SCOTT, sales agent, Pleasant Grove, Utah. In an order dated March 17, 2021, Mr. Sullivan's license was granted and placed on probation for the initial licensing period for doing landscaping work in excess of $1,000 without a license, for unpaid child support, and for criminal history. Case number RE-21-125731

VARGO, SHAUN, sales agent, Grantsville, Utah. In an order dated April 6, 2021, Mr. Vargo's license was granted and placed on probation due to a pending criminal matter. Case number RE-21-126131

WHITNEY, RYAN, sales agent, Salt Lake City, Utah. In an order dated April 1, 2021, Mr. Whitney's license was renewed and placed on probation for the renewal period due to a plea in abeyance agreement in a criminal matter. Case number RE-21-126037

TIMESHARE

JONES, PARKER B., timeshare salesperson, Sandy, Utah. In a stipulated order dated April 6, 2021, Mr. Jones admitted that he failed to disclose a pending criminal matter in his application to renew his registration and that the application contained untrue or misleading information, in violation of Utah law. Mr. Jones agreed to pay a civil penalty of $500. Case number TS-21-126034

Instructor Development Workshop Registration

Wednesday and Thursday, October 27th and 28th

Sheraton Park City

The Division of Real Estate will be holding its annual Instructor Development Workshop (IDW), Wednesday and Thursday, October 27th and 28th, at the Sheraton Park City.

Attendance at the two-day IDW is REQUIRED once every two years for all real estate, mortgage, and appraiser pre-licensing instructors, as well as real estate continuing education instructors who teach the Mandatory Course. Mortgage and appraisal CE instructors are invited to attend this course, although no CE credit can be given. Only Real Estate instructors (pre-license and continuing education) as well as attending real estate licensees, will receive 13 hours of core continuing education credit for attendance at this outstanding training event. Please keep in mind that CE credits are only awarded in full-day segments.

Craig GrantCraig Grant "The Real Estate Tech Guru" from Stuart, Florida will be the featured presenter for this two-day event. Craig presents over 150 speaking engagements around the country every year including some of the industry's top events for NAR, CRS, many state associations, and national franchises. Mr. Grant will engage our industries' instructors to improve their techniques and skills.

Among other things, Craig plans to "raise attendees' overall tech skill level." "He will show you how you can modernize your classrooms and perform technology marketing."

The morning of October 27th, Division staff will present industry updates and information to the participants.

Registration is now being accepted for this event. Please complete the following registration form and return it to the Division with payment to reserve your seat. Registration numbers are limited and will be filled on a first come, first served basis.

Credits

Director: Jonathan Stewart

Editor/Contributor: Mark Fagergren

Contributor/Layout: Kendelle Christiansen

Contributor/Layout: Lark Martinez

Contributor: Kadee Wright

Contributor: Justin Barney

Contributor: Van Kagie

Contributor: Laurel North

Webmaster: Jason Back

2021 Published by

Utah Division of Real Estate

Department of Commerce

160 E 300 S

PO Box 146711

SLC UT 84114

(801) 530-6747

Real Estate Commissioners

Rick Southwick, Chair

Lori Chapman, Vice Chair

James Bringhurst

Marie McClelland

Randy Smith

Mortgage Commissioners

Kay R. Ashton, Chair

G. Scott Gibson, Vice Chair

Cathy J. Gardner

George P. Richards

Jeff England

Appraiser Licensing and Certification Board Members

Jeffrey T. Morley, Chair

Keven Ewell, Vice Chair

Ben Brown

Kris Poulson

Richard Sloan