Newsletters

1st Quarter 2024 Real Estate Newsletter

In this issue:

- Real Estate Announces New Director Leigh Veillette

- Interim Director's Message - 2024 Legislative Update

- Rule Developments Since December 1, 2023

- 2024 Mortgage Reinstatement Period Has Ended

- Caravan 2024

- Important Reminder - New Agent Course Requirement

- Division Staff Spotlight

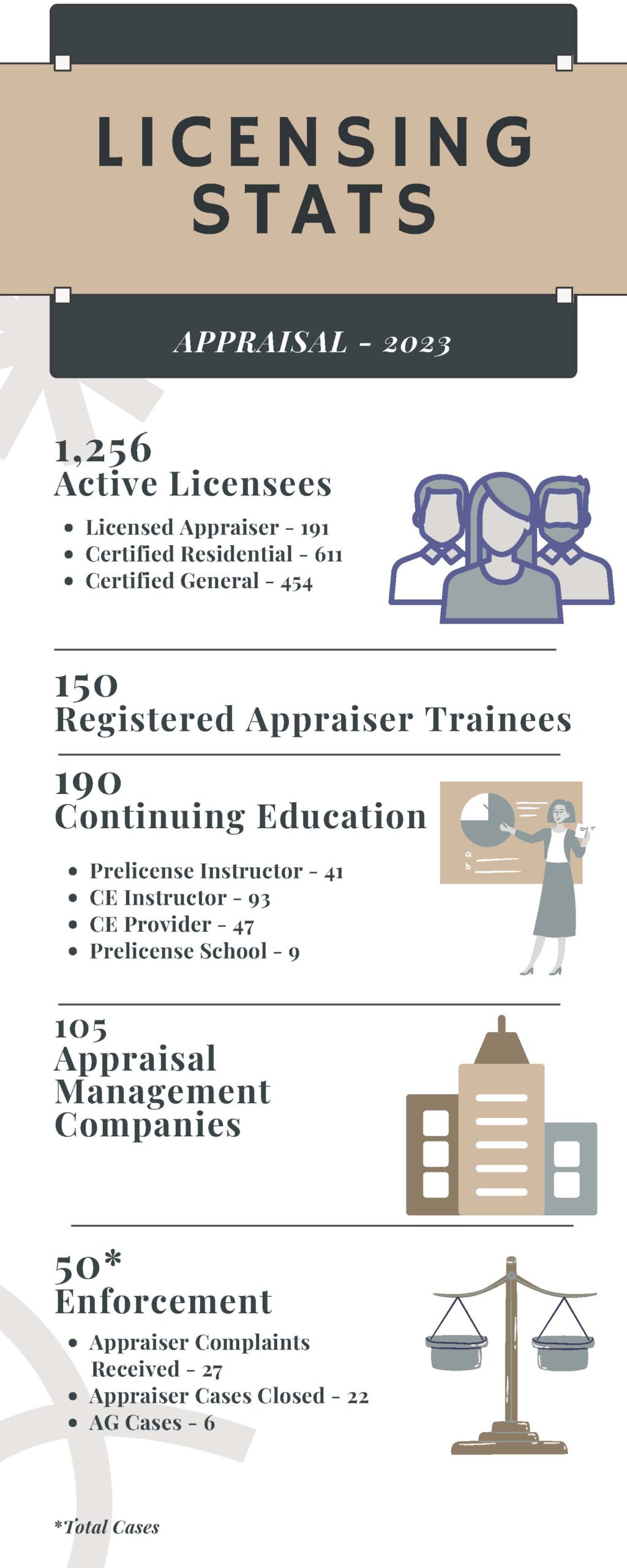

- 2023 Licensing Stats

- Most Common Complaints

- 1st Quarter Licensing and Disciplinary Actions

- Timeshare Owners Beware

- Mandatory 2024 Course Outlines

- Mortgage Q1 MCR Filing

- Affiliated Business in Title Insurance

- Appraisal Foundation Announces Criteria Changes

- Appraisal PAREA Experience Modules

- Newsletter Feedback QR Code

- Social Media Links

- Credits

Real Estate Announces New Director Leigh Veillette

The Utah Division of Real Estate is excited to announce the appointment of Leigh Veillette as the new Director of the Utah Division of Real Estate. Having previously served as the director of the Division of Corporations and Commercial Code, Veillette steps into her new role with an impressive background in regulatory oversight and legal analysis. Prior to her appointment with DCCC in 2021, Veillette began her career in Commerce at the Division of Consumer Protection, where she worked as an investigator and later as a legal analyst.

“I’m very grateful for this opportunity,” said Veillete. “Protecting the people of Utah through education and responsible regulation has been a cornerstone of my career. I am energized by this new challenge overseeing such a vital sector of Utah's economy.”

Veillette holds a bachelor’s degree in history, summa cum laude, from Auburn University, and a law degree from the University of Alabama School of Law. Despite her ties to Alabama, she remains a dedicated Auburn fan. Her legal career began as a Judicial Law Clerk for the Honorable Chris M. Comer in the 23rd Judicial Circuit of Alabama, laying a strong foundation for her subsequent roles in public service and leadership.

Interim Director's Message - 2024 Legislative Update

H.B. 500 – Real Estate Amendments. Sponsors Representative Calvin R. Musselman and Senator Kirk A. Cullimore assisted the Division by running the Division’s annual Bill. H.B. 500 includes the following provisions:

- It removes the 10-day reporting requirement for criminal convictions for real estate and appraiser licensees. The 10-day reporting requirement is no longer necessary as these licensees are now enrolled in the FBI fingerprinting RAP Back System.

- It allows for an enhanced penalty for real estate and mortgage licensees for a violation of Utah law or administrative rule against an elderly or vulnerable adult. The enhanced penalty increases the potential maximum violation from $5,000 to $10,000 for a violation against a person over the age of 65 or against a vulnerable adult.

- It requires that the Division notify the supervising real estate broker:

- when a complaint is made against a licensee that requires a written response;

- of the time and place of any disciplinary hearing held against a licensee;

- of the resolution of an alleged violation against a licensee; and

- when requested by the broker, any disciplinary actions taken by the Division against a licensee in the past five years.

Removal of the 10-day reporting requirement and the enhanced penalty for a violation against an elderly person or a vulnerable adult were discussed with and approved by the Real Estate and Mortgage Commissions, and the Appraiser Board. The notice to the supervising broker was an amendment added to the Division’s Bill by Representative R. Neil Walter, a member of the Utah House of Representatives who is also a licensed principal broker. After some discussion and editing of the notice requirement, the Division supported this amendment to the Division’s Bill. H.B. 500 passed the legislature and has been signed by Governor Cox.

The Division appreciates the support we received from Representative Musselman and Senator Cullimore with our annual Bill.

The changes made in H.B. 500 go into effect on May 1, 2024. This article only highlights changes to the existing laws. If you have questions, please read the exact language in the Bill or contact the Division.

Other Legislation

In addition to H.B. 500, other bills relating to real estate, mortgage, and appraisal law were passed by the legislature and have been signed into law by the Governor.

H.B. 216 –Eliminating Minimum Time Requirements for Professional Training. Sponsors Representative Norman K. Thurston and Senator Curtis S. Bramble. This Bill would eliminate minimum time requirements to qualify for certain professional training, including for licensed and certified residential appraisers. However, H.B. 216 includes an exception for minimum time requirements that are federally mandated. If/when the federal criteria for minimum time requirements for appraiser experience are eliminated, the state law requiring minimum time requirement for appraiser experience will automatically end.

SB 151 –Fraudulent Deed Amendments. Sponsors Senator Curtis S. Bramble, Representative Kera Birkeland. The Division has received several reports of fraudulent deeds having been recorded. This Bill creates civil liability for an individual who records a fraudulent deed, provides for damages of $10,000 or treble damages, whichever is greater, and provides for a court hearing to take place within ten days to determine if a deed is fraudulent. If the deed is fraudulent, the court may rule that the deed is void and direct the county recorder to remove the deed from county records.

Several affordable housing bills were passed by the legislature and signed by Governor Cox.

S.B. 168 – Affordable Building Amendments. Sponsors Senator Lincoln Fillmore and Representative Stephen L. Whyte. Enacts a statewide building code for modular building units, modifies the First-Time Homebuyer Assistance Program, and other changes.

S.B. 268 – First Home Investment Act. Sponsors Senator Wayne A. Harper and Representative Calvin R. Musselman. Allows a municipality to create a first home investment zone, encourages mixed use development, encourages strategic and efficient land use planning, increases opportunities for home ownership, and provides for tax increment financing. (Must be owner occupied for 25 years).

HB 465 - Housing Affordability Revisions. Sponsors Representative Stephen L. Whyte and Senator Lincoln Fillmore. The bill authorizes redevelopment agencies and community development agencies to use funding to pay for or contribute to the acquisition, construction, or rehabilitation of income targeted housing, under certain circumstances. It also modifies the Utah low-income housing tax credit, encourages utilizing land use authority to increase the supply of housing in the state, and makes other changes to Utah law.

HB 476 – Municipal Land Use Regulation Modifications. Sponsors Representative Stephen L. Whyte and Senator Lincoln Fillmore. Requires that a municipality accept and process a complete land use application under specified conditions, modifies development agreements, modifies limits on building design elements, authorizes municipalities to require a seller to notify the buyer of waterwise landscaping requirements, enacts language relating to review of subdivision applications and subdivision improvement plans, modifies provisions relating to landscaping of residential lots or open space, modifies enforcement of municipal land use regulations, and adds an exception to the optional use of the Utah coordinate system.

SB 234 – Mortgage Commission. Sponsors Senator Michael K. McKell and Representative Brady Brammer. The purpose of this Bill is to clarify the attorney exemption under the Mortgage Act. As an example, if the Division receives a complaint against an attorney who engaged in loan modification for a legal client, the Division should refer the complaint to the Utah State Bar for disciplinary rather than investigating the complaint within the Division. Even if the attorney voluntarily obtains a mortgage license, the attorney would not be subject to the provisions of the Mortgage Act if the attorney is acting as attorney for an individual or entity regulated by the Division. The Bill is limited and only addresses attorneys in these specific certain circumstances.

If you have questions about these statutory changes, please contact the Division for additional information. We appreciate all those who provided feedback and suggestions that resulted in these changes.

Rule Developments since December 1, 2023

Appraisal Management Company Rules

Appraisal

Mortgage

Real Estate

Timeshare and Camp Resort

2024 Mortgage License Reinstatement Period Has Ended

The 2024 renewal period for mortgage licenses ended on December 31st, 2023. Mortgage licensees who missed the renewal deadline were given two additional months to reinstate their licenses from January 1st to February 29th, 2024. At the start of our renewal period, 9,889 mortgage licenses were eligible for renewal. By the end of our reinstatement period, a total of 8,052 licenses were renewed for the 2024 year; of that total, 6,807 were individual licenses (MLO & LM), 890 were entity licenses, and 351 were branch licenses.

Individuals who failed to reinstate their license by February 29th, 2024, or allowed their license to expire on December 31st, 2023, must complete the following requirements by December 31st, 2024, to obtain a new license.

- Complete the 10-hour late CE requirement for 2023 (federal 8 hours and Utah 1-hour law course) if CE was not completed in 2023

- Reapply for a new license and pay all licensing fees through the NMLS.

(Individuals with a license expiration date exceeding one year should contact the division to determine any additional requirements they may need to complete to obtain a new license.)

Expired entities and branches may reapply for a license by requesting a new license directly through the NMLS.

Caravan 2024

Attention! The Division of Real Estate is offering a FREE *3-hour CORE continuing education course for real estate, appraiser, and *mortgage licensees. Licensees are invited to attend any of the nine *3-hour CORE CARAVAN sessions held throughout the state.

Justin Barney, Interim Director of the Division of Real Estate, Kadee Wright, Chief Investigator, and Mark Fagergren, Director of Licensing and Education, will discuss current issues and hot topics facing the real estate, mortgage, and appraisal industries. They will also be available to answer any questions or address your concerns as a licensee.

These events are FREE. However, limited capacity necessitates a first come, first served electronic reservation system to save your seat. The dates and locations for these events are posted below, but please remember, these sessions fill up quickly, so DO NOT WAIT TO REGISTER! If a location is full, there may be room for walk-ins based on available space, but walk-in admission is not guaranteed!

To register, click the link here: 2024 Caravan Registration

|

Vernal April 9, 2024 TownePlace Suites by Marriott |

Moab May 7, 2024 Grand Center |

|

Layton April 18, 2024 |

Richfield May 8, 2024 Snow College

|

|

Park City April 23, 2024 Sheraton Park City |

Cedar City May 9, 2024 Courtyard by Marriott

|

|

Provo April 30, 2024 Utah Valley Convention Center |

St George May 10, 2024 Utah Tech University |

|

|

Logan May 16, 2024 Bridgerland Technical College Logan Campus |

You will receive an email with additional registration information before the event you have registered for. If you have any questions, please email sbargas@utah.gov. We look forward to seeing you all soon!

*Mortgage licensees will receive 1 hour of credit for attending the full course to fulfill their state-specific CE requirement

Important Reminder: 12-Hour New Agent Sales Course For Recently Licensed Salespersons

Recently licensed real estate salespersons (who have not renewed their real estate license while on active license status) are required to complete the 12-hour New Agent Sales Course for Real Estate Agents during their initial license renewal cycle. This course was created to assist new agents during the critical transition period after licensing. New agents are uniquely challenged during this initial licensing stage.

The course was prepared to assist those individuals making this transition and to help them in dealing with the realities they are exposed to as newly practicing licensees. Completion of this course will fulfill 12 hours of Core Topic Courses of the new agent's CE requirement during their original licensing period.

New agents must complete EACH of the following:

- The 12 Hour New Agent Course,

- A Mandatory 3 Hour Course,

- 3 hours of any other approved CE course(s)

To satisfy their 18-hour CE renewal requirement in order to apply to renew their license.

There are no substitute courses that may be taken in place of the New Agent Sales Course or the Mandatory Course. Credit for these courses must be “banked” in the licensee’s “CE Courses Completed” section of their individual Online RELMS account to allow for a timely license renewal.

New agents needing this course can view a list of approved course providers here:

https://db.realestate.utah.gov/education-course-search/index

Attendees of this course will have a better understanding of the proper use of:

- Forms

- Contracts

- Properly pricing properties for sale

- State laws

- Federal laws, and

- Fraud

The course has demonstrated an ability to assist new agents in dealing with market challenges while also encouraging licensees that competent, hard-working, and ethical practitioners can succeed.

Division Staff Spotlight

Please welcome our newest Real Estate Investigator, Adam Martin! Adam joined the Division in August of 2023 and previously worked for the State Department of Insurance as a Title and Escrow Investigator Specialist. Adam also worked for eighteen years as a part-time licensed sales agent and part-owner of a real estate company, where he developed his love of the real estate market.

Originally from a small town in Tennessee called Cookeville, Adam always dreamed of traveling and seeing the world. By joining the Air Force as a base police officer, he achieved his dream! Adam was able to experience life in six different states and even spent three years in Germany. He finished his Air Force education and training in California as an Air Force nurse. In total, Adam successfully served the country that he loves for 33 years.

Adam met and then married the love of his life, Leslie. Together, they have four children: Hayden, Darek, Ava, Xavier (deceased), and two granddaughters, Charlett, and Oakley. Adam and his family live near the Idaho border in Richmond, Utah, and although he wakes up most mornings to the lovely smell of farm animals and dairy farms, he has grown to appreciate them and loves where he lives.

Most mornings, Adam can be found doing one of his favorite things, a four-to-five-mile combined walk, jog, and run. His daily exercise routine keeps him on track, focused, and ready for the day! When not outdoors, he also enjoys collecting old coins, turquoise, and fossils and has quite an extensive collection. Welcome to the Division, Adam!

Most Common Complaints

The Division often receives inquiries about the types of complaints that we receive. With the help of the enforcement's new case-tracking software, this question can be easily answered. This search was limited to July 2023 through January 2024. Complaints can contain one or multiple alleged violations, but this analysis will only focus on the major violations addressed in each complaint. The chart below illustrates the top five most common complaints for each industry.

|

Real Estate Top 5 |

Mortgage Top 5 |

Appraisal Top 5 |

|||

|

Unlicensed Activity |

22 |

Advertising |

3 |

Improper Comparables |

7 |

|

Advertising |

16 |

Dishonesty Fraud |

3 |

Misleading Report |

3 |

|

Property Management |

15 |

Misrepresentation |

3 |

Misrepresentation |

2 |

|

Breach Fiduciary Duty |

12 |

Licensing Action |

3 |

Improper Methods |

2 |

|

Licensing Action |

75 |

Referral Fee |

1 |

Other |

3 |

The chart above shows violations alleged in the complaint, not the outcome of the Division’s investigations.

During the specified time period, the Division received 206 Real Estate Complaints, 22 Mortgage, and 17 Appraisal complaints. The variety of alleged violations reported by complainants is interesting to licensees and Division staff alike, as it helps us focus our attention on persistently recurring problem areas.

The Division will use this information to help guide presentations to the industries we serve which may also assist brokers with training topics at their brokerages.

First Quarter Licensing and Disciplinary Actions

Please note that Utah law allows 30 days for appeal of an order. Some of the actions below might be subject to this appeal right or currently under appeal.

To view a copy of an order referenced in this article please visit the Utah Division of Real Estate Disciplinary Actions Search at: http://realestate.utah.gov/licensing-and-disciplinary-actions/

APPRAISAL/AMC

MORTGAGE

MABEY, ASHLEY, mortgage loan originator, Salt Lake City, Utah. In an order dated December 14, 2023, Ms. Mabey’s license was granted and placed on probation for approximately two years due to criminal history. Docket number RE-2023-107

MANGELSON, PAUL, unlicensed, Sandy, Utah. In a stipulated order dated January 3, 2024, Mr. Mangelson admitted that he advertised and brokered a residential mortgage loan without first obtaining a mortgage license, in violation of Utah law. Mr. Mangelson agreed to pay a civil penalty of $3,000. Docket number RE-23-5040 and Division Case No. MG-20-115607

REAL ESTATE

ALLEN, CHRISTOPHER, sales agent, Cottonwood Heights, Utah. On January 18, 2024, the Division issued a citation to Mr. Allen for failing to produce documents or records requested by the Division within 10 days after the date of the request. The citation assessed a fine in the amount of $1,000. Citation # RE-2024-003, Case # 145387

WILLIAMS CHASE AMES, sales agent, St. George, Utah. On February 20, 2024, the Division issued a citation to Mr. Ames for advertising on social media without identifying the broker with which he is affiliated. The citation assessed a fine in the amount of $500. Citation # RE-2024-017, case # 144688

CHAVEZ, ANTHONY WILLIAM-FINIS, sales agent, West Valley City, Utah. In an order dated January 25, 2024, Mr. Chavez’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2024-005

CONNER, ABRAHAM THOMAS, sales agent, Cottonwood Heights, Utah. In an order dated September 28, 2023, Mr. Connor’s license was renewed and immediately suspended due to pending criminal charges. The order also provided that should Mr. Conner be convicted of a felony, his license would be immediately revoked. Mr. Connor appealed the Division’s decision and requested that the decision be reviewed by the Real Estate Commission. Mr. Conner did not appear at the Commission review hearing held February 21, 2024, but instead, requested that the prior order suspending his license be confirmed. Sometime after the Division’s September 28, 2023 order, Mr. Conner pleaded guilty to a 2nd degree felony and a class A misdemeanor and, pursuant to the September 28, 2023 Division order, his license was revoked. Docket number RE-2023-075

DAVIS, JOSEPH, principal broker, American Fork, Utah. In an order dated January 10, 2024, Mr. Davis’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-108

DOUGHERTY, MALLORY JOANNE, sales agent, West Jordan, Utah. In an order dated December 20, 2023, Ms. Dougherty’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2023-109

GRANT, DAVID, principal broker, Draper, Utah. In a stipulated order dated February 21, 2024, Mr. Grant admits that he obtained permission to show a client a home listed with another agent. During the showing, and without the knowledge or consent of the seller or seller’s agent, he recorded himself walking through the home commenting on features that he did not like. Mr. Grant posted the video to a social media account without the consent of the homeowner or the listing agent but later removed it. When asked about it by the Division, Mr. Grant denied the existence of the video. In a subsequent interview with the Division, Mr. Grant admitted the existence of the video and that he had posted it on social media. Mr. Grant admits that his conduct violated Utah law and administrative rules. He agreed to pay a civil penalty of $5,000 and to complete six hours of continuing education in addition to the continuing education required for his next license renewal. Docket number RE-23-5041 and Division case No. RE-22-135907

GRIFFIN, TINA, principal broker and dual broker, St. George, Utah. In a stipulated order dated February 21, 2024, Ms. Griffin admits that she failed to provide active and reasonable supervision over a sales agent affiliated with her brokerage, allowed an unlicensed person to conduct real estate activities requiring a license, and allowed the unlicensed person to receive compensation for real estate related activities. Ms. Griffin admits that her conduct violated Utah law. She agreed to pay a civil penalty of $10,000 and to complete three hours of continuing education in addition to the continuing education required for her next license renewal. Docket number RE-24-5050, and DRE case No. RE-21-129525

HO, ANDREW, sales agent, Holladay, Utah. On February 27, 2024, the Division issued a citation to Mr. Ho for advertising on social media without identifying the brokerage with which he is affiliated. The citation assessed a fine in the amount of $500. Citation # RE-2024-019, case # 143675

ISAKSEN, KARI, principal broker, St. George, Utah. On or about October 15, 2023, the Division issued a citation to Ms. Isaksen for failing to respond to a request by the Division within 10 days and failing to provide requested documents. The citation assessed a fine in the amount of $1,000. Citation # RE-2023-091 and case number 142772

JABLONSKY, RAYMOND, sales agent, Pomona, California. On February 27, 2024, the Division issued a citation to Mr. Jablonsky for advertising on social media without identifying the brokerage with which he is affiliated. The citation assessed a fine in the amount of $500. Citation # RE-2024-020, case # 144641

JURY, STEPHEN L., associate broker, Park City, Utah. On February 12, 2024, the Division issued a citation to Mr. Jury for sending mail advertisements that did not identify the brokerage with which he is affiliated. The citation assessed a fine in the amount of $500. Citation # RE-2024-012, case # 142150

KOZLOWSKI, TRAVIS, sales agent, Draper, Utah. In a stipulated order dated February 21, 2024, Mr. Kozlowski admits that he made an offer to purchase a property and the assisted living business operating at the property in the name of a limited liability company that he intended to form but that was not formed at the time. In his offer, Mr. Kozlowski did not disclose that he was a principal and a licensee in the transaction and did not notify his broker of the transaction. Mr. Kozlowski later approached an acquaintance of his who offers short term loans to purchase the property so that he could later purchase it back. His actions in this case violate Utah law and administrative rules. Mr. Kozlowski agreed to pay a civil penalty of $3,000 and that he would not reapply for a real estate sales agent license for at least five years from the date of the stipulated order. Docket number RE-24-5045 and Division case number RE-20-117394

LANE, ASHLEY KIRSTEN, sales agent, Bluffdale, Utah. In an order dated December 28, 2023, Ms. Lane’s license was granted and placed on probation for the initial licensing period due to two cases in which she entered into a plea in abeyance agreement with regard to criminal charges. Docket number RE-2023-114

MARIN, REYNA, sales agent, West Valley City, Utah. In an order dated December 20, 2023, Ms. Marin’s license was granted and placed on probation for the initial licensing period due to charges in a criminal matter. Docket number RE-2023-110

MUNOZ, ESTELLA, sales agent, Salt Lake City, Utah. On February 20, 2024, the Division issued a citation to Ms. Munoz for advertising on social media without identifying the brokerage with which she is affiliated. The citation assessed a fine in the amount of $500. Citation # RE-2024-013, case # 143584

OCKEY, CATHERINE R, sales agent, Riverton, Utah. In an order dated September 29, 2023, Mr. Ockey’s application for licensure as a real estate sales agent was denied due her criminal history. Docket number RE-2023-078

OLSEN JACOB, sales agent, North Logan, Utah. In an order dated December 26, 2023, Mr. Olsen’s application to reinstate his license was denied due to a criminal matter occurring during the past licensing period. His license was placed on probation for the renewal period. Docket number RE-2023-112

OWENS, SHARA, sales agent, Roy, Utah. In an order dated December 14, 2023, Ms. Owens’s license was renewed and, due to a plea in abeyance agreement in a criminal matter during the past licensing period, her license was renewed and immediately suspended for three months and will be then placed on probation for the remainder of the renewal period. Docket number RE-2023-106

PUGHE-AVILA, MIRANDAH DANIELLE, sales agent, Ogden, Utah. In an order dated February 16, 2024, Ms. Pughe-Avila’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2024-014

REBER, VANCE, sales agent, Washington, Utah. In an order dated December 28, 2023, Mr. Reber’s license was renewed and, due to a criminal matter occurring during the past licensing period, his license was placed on probation for the renewal period. Docket number RE-2023-111

RINCK, AARON MAX, sales agent, Park City, Utah. In an order dated December 28, 2023, Mr. Rinck’s license was renewed and, due to a criminal matter occurring during the past licensing period, his license was placed on probation for the renewal period. Docket number RE-2023-113

SIMMONS, KELI, sales agent, Salem, Utah. In an order dated December 8, 2023, Ms. Simmons’s license was renewed and, due to a plea in abeyance agreement in a criminal matter during the past licensing period, her license was immediately suspended for three months and placed on probation for the remainder of the renewal period. Docket number RE-2023-105

STEPHENSON, SCOTT J., sales agent, St. George, Utah. In a stipulated order dated February 21, 2024, Mr. Stephenson admits that he signed a listing agreement to represent the seller in a property transaction. The seller and buyer initially entered into a real estate purchase contract (REPC), but later entered into a lease agreement with an option to purchase the property (Lease Option). Mr. Stephenson is also named as the seller’s representative in the Lease Option. The REPC was not completed. Mr. Stephenson and the seller negotiated for one-half of the amount that would have been paid as a sales commission from the REPC to be paid directly to Mr. Stephenson as compensation for the Lease Option. The supervising broker was not informed of the Lease Option transaction. Mr. Stephenson admits his conduct violates Utah law and Administrative rules. He agreed to pay a civil penalty of $3,000 and to complete three hours of continuing education in addition to the continuing education required for his next license renewal. Docket number RE-23-5034 and DRE case number RE-20-116963

STRINGHAM, SCOTT, sales agent, Bountiful, Utah. In an order dated December 1, 2023, Mr. Stringham’s license was renewed and, due to a plea in abeyance agreement in a criminal matter during the past licensing period, his license was placed on probation for the renewal period. Docket number RE-2023-103

TAYLOR, SOPHIA CHRISTINA, sales agent, Clearfield, Utah. In an order dated January 12, 2024, Ms. Taylor’s license was granted and placed on probation for the initial licensing period due to criminal history. Docket number RE-2024-002

VALDEZ, ALAN ABDIEL, sales agent, West Valley City, Utah. In an order dated December 7, 2023, Mr. Valdez’s license was granted and placed on probation due to unpaid child support. Mr. Valdez’s license will remain on probation until he demonstrates to the Division that he has made regular and frequent payments to substantially reduce the outstanding amount of child support. Docket number RE-23-5035

WELLS, GAIL MARIE, sales agent, Moab, Utah. In an order dated December 1, 2023, Ms. Wells’ license was renewed and, due to a criminal matter occurring during the past licensing period, her license was placed on probation for the renewal period. Docket number RE-2023-104

WILLEY, LARY SCOTT, sales agent, Sandy, Utah. In a stipulated order dated February 21, 2024, Mr. Willey acknowledges that he hired videographers to create video clips of him showing homes to buyers. He then contacted a seller’s agent to schedule a showing of a listed property. On the day of the showing, Mr. Willey allowed two videographers to enter the property with the intention to create a personal real estate advertisement without the permission of the owner. He admits that he left the videographers unattended inside the home for several minutes while he left to change his clothes. He returned and several minutes of video were completed. The homeowner returned while the videographers were at the home. When confronted by the homeowner, Mr. Willey told the owner that he was filming the home for his client’s husband who could not be present for the showing. However, this was not a standard showing. Mr. Willey did not have an agency agreement with the person to whom he showed the home. A few days later, Mr. Willey apologized to the owner and acknowledged that he should have obtained permission to film the home prior to doing so. Mr. Willey’s actions are a violation of Utah law and administrative rules. He agreed to pay a civil penalty of $5,000 and to complete three hours of corrective continuing education in addition to the continuing education required for his next license renewal. Docket number RE-23-5039 and Division case number RE-22-136087

TIMESHARE

Timeshare Owners Beware

One sentence of warning: “If it’s too good to be true, it probably is.” Mexican timeshare owners in Utah are receiving telemarketing offers to purchase your once beloved timeshares in Mexico for a “lottery like” payoff. Enticements to pay you double, triple or even 10 times the value of your original purchase are being proposed by carefully crafted and seemingly legitimate “Timeshare Exit or Resale Companies,” to take your seldom used timeshare off your hands.

Once timeshare owners take a bite out of the irresistible carrot of a timeshare buyback, a contract will arrive via email for them to peruse along with being assigned their personal facilitator that will take care of all the details of payment. This contract looks legitimate. The facilitator is skilled in sales techniques and has a polished answer for any inquiries about whether they or their business are licensed in Utah. If you look for the company business license and address, it will be found. But if you dig deeply enough, it’s all a scam. The business name and address will be a currently operating business with no affiliation to the telemarketer. If you ask if they are a licensed sales agent, they will say that they have reciprocity from another state. But this is an untrue statement.

Your facilitator will send you counterfeit bank statements and set up a falsified escrow account holding the promised full payoff amount for the purchase of your timeshare. All you have to do is wire money into the company’s Mexican bank account in order to get access to the escrow account monies. That first payment will be for thousands of dollars, sometimes more than you paid for your original timeshare. Then there will be subsequent requests from the Mexican Government requiring you to pay thousands of dollars in taxes before your money will be released. Then….there will be additional requests for payment until you finally say No. If a telemarketer asks you to wire money to Mexico….you are probably never going to see that money again.

Utah residents, as well as people across the nation, have fallen prey to this scam time and time again and have lost tens of thousands and even millions of dollars only to be left waiting for their big payoff. The USA today has an informative article recently published linking this activity to the Jalisco New Generation Cartel in Mexico.

USA Today - Thousands of Americans Fall Prey to Mexican Cartel Timeshare Scam

We are receiving complaints about his activity at the Division of Real Estate but don’t have jurisdiction over International Crimes. If you have been contacted or have fallen victim to this scheme, please contact the FBI. They investigate this type of activity.

Internet Crime Complaint Center

If you are considering purchasing or reselling a timeshare, please refer to the Federal Trade Commission website: https://consumer.ftc.gov/articles/timeshares-vacation-clubs-and-related-scams

Real Estate Licensees:

Mandatory 2024 Course Outlines

Since January 1st of this year, the 2024 3-hour Mandatory Course Outlines for real estate licensees have been adopted and are to be taught for the remainder of the year.

Licensees may select any of the four versions of the Mandatory Course that best meets their individual area of specialty or focus. The four Mandatory Courses are:

- Mandatory Residential,

- Mandatory Property Management (Residential),

- Mandatory Property Management (Commercial), and

- Mandatory Commercial

Active real estate licensees are required to complete a total of 18 hours of continuing education to renew their license. A minimum of 9 of the 18 hours must be Core Topic Courses. 3 of the 9 required Core Topic Course hours must be satisfied by completing the Mandatory 3-Hour Real Estate Commission Approved “Mandatory Course.”

Licensees may elect to complete more than a single mandatory course specialty if they choose to do so, although they may only receive CE credit for one Mandatory “Residential (MR),” “Commercial (MC),” and/or “Property Management (MP)” course in the same renewal cycle. In other words, a licensee could choose to attend more than one Mandatory Course

specialty (i.e. Residential, Commercial or Property Management), but NOT take more than one course for continuing education credit from the same Mandatory Course Specialty in the licensees’ same renewal cycle.

Much consideration of both timely and essential content has gone into the development and approval of these significant courses.

The Division and Real Estate Commission are confident that the material contained within the 2024 Mandatory Course outlines will be very informative and helpful for licensees to navigate the many challenges faced in the dynamic and ever changing Utah real estate market.

Mortgage Q1 MCR Filing

-Due Date Delayed Until June 15, 2024-

The NMLS has requested that the Division offer a grace period for the new Q1 2024 Mortgage Call Report (FV6) filing submission as our Utah statute allows.

Accordingly, the Division has extended the Q1 MCR FV6 filing due date for data occurring between January 1, 2024 – March 31, 2024. Utah Mortgage Companies (Entities) will have an additional 31 days until June 15, 2024 to submit their Q1 Mortgage Call Report (FV6).

The Q2 2024 MCR (FV6) filing due date will remain the same (August 14, 2024).

Affiliated Business in Title Insurance

With the passage of SB 121, Affiliated Business in Title Insurance was enacted on May 14, 2019.

Utah Code § 31A-23a-1001 defines:

- Affiliated business means the gross transaction revenue of a title entity’s title insurance business in the state that is the result of an affiliated business arrangement.

- Affiliated business arrangement means the same as that term is defined in 12 U.S.C. Sec. 2602, except the services that are the subject of the arrangement do not need to involve a federally related mortgage loan.”

The law generally did three things:

- Repeal provisions of Utah Code § 31A-23a-503, which prohibited title business referrals from certain persons who have a financial interest in the title insurance entity, to which the person refers the title business.

- Authorizes the Division to impose sanctions for violations of Section 8 of RESPA (Real Estate Settlement Procedures Act, 12 U.S.C. Sec. 2601 et seq).

- Makes the Division responsible for enforcing the law.

RESPA prohibits payment of referral fees, unearned fees, or kickbacks, as well as splitting or sharing of fees or charges made or received for providing real estate settlement services.

However, there is an exception in RESPA for affiliated business arrangements if certain conditions are met:

- Disclosure is made of the existence of such an arrangement to the person being referred.

- Cannot require a person to use their settlement services; and

- The only thing of value received from the arrangement is the amount of ownership.

To understand the use of the words “new” or “newly affiliated title entity” as defined in

Utah Code § 31A-23a-1001(7).

- A “new or newly affiliated title entity” is licensed as a title entity for the first time on or after May 14, 2019, or is licensed as a title entity before May 14, 2019, and enters into an affiliated business arrangement for the first time on or after May 14, 2019.

An affiliated business arrangement between a person and a title entity violates Section 8 of RESPA for purposes of state law if:

- More than 70% of the title entity's annual title insurance business is affiliated on or after the later of two years after a title entity begins an affiliated business arrangement or June 1, 2021.

- Sufficient capital and net worth: $100,000 in a reserve account, in the title entity’s name.

- In addition, Utah law requires the affiliated business entity to staff their own employees, have a physical office space separate from the affiliated business entity, and pay a fair market rent.

- Furthermore, the affiliated business must perform the essential functions of title business itself, and where the person referring business to the affiliated title entity also refers business to other title entities.

Utah Code § 61-2f-401(26), requires timely disclosure to a buyer or seller of an affiliated business arrangement.

The entity must file an annual report of its business activities with the Division by March 1 of each calendar year. The report requires the following disclosures:

- Name and address of any producer or associate that owns a financial interest in the affiliated title entity.

- For each producer and associate, list the percentage of the title entity’s affiliated business that is a result of an affiliated business arrangement.

- Describe any affiliated business arrangement you have with a person other than a producer or associate identified.

- In the preceding calendar year, what is the percentage of the new or newly affiliated title entity's annual title insurance business that is affiliated business?

- Proof of Sufficient Capital and Net Worth.

The annual affiliated business report form and frequently asked questions can be found on our website at https://realestate.utah.gov/affiliated-title/.

A list of agencies with Affiliated Business in Title Insurance can be found on our website https://realestate.utah.gov/affiliated-title/current-affiliated-businesses/.

An investigator has been assigned to audit all affiliated business arrangements in title agencies who have filed an annual affiliated business report with the Division. The audit will detail the statutory requirements set forth in this newsletter.

The Appraisal Foundation Announces Criteria Changes

-Effective January 2026-

The Appraisal Foundation has provided an update on the 2026 Criteria requiring Continuing Education and Qualifying Education on Valuation Bias and Fair Housing Laws and Regulations:

Effective 01/01/26, appraisers must complete an approved course on Valuation Bias and Fair Housing Laws and Regulations, once every license renewal cycle.

- a) The first time the appraiser completes the course, the course length must be 7-hours.

- b) Once in every license renewal cycle thereafter, the course length must be at least 4-hours.

There will also be an increase in Qualifying Education requirements for Trainee and Licensed appraisers a total of 8-hours for each classification.

Updated Course Title: The 7-hour National USPAP Update Course will be changed to The 7-hour USPAP Continuing Education Course.

Appraisal PAREA Experience Modules

(Licensed & Certified Residential)

The Practical Application of Real Estate Appraisal (PAREA) modules for both Licensed and Certified Residential candidates are now available. PAREA modules are an accepted alternative to the traditional prerequisite of working with and being supervised by, a Certified Appraiser to acquire the necessary 1,000 hours of experience (for Licensed Appraisers) and the additional 500 hours of experience (for Certified Residential Appraisers).

The existing Trainee/Supervisory mentorship model continues to be a viable, successful means to become an appraiser. With the addition of PAREA, there are now two recognized and accepted pathways toward gaining the necessary experience required to become either a Licensed and/or Certified Residential Appraiser.The Appraisal Institute (AI) is currently the first and only PAREA provider to be approved by the Appraisal Qualifications Board (AQB) to offer these standardized approaches to gaining the experience necessary to become a Licensed and/or Certified Residential Appraiser.

Appraisal candidates can now complete their experience to become Licensed or Certified Residential Appraisers via either the traditional Trainee/Supervisor method or the PAREA method (or vice versa); however, “partial” traditional experience and “partial” PAREA experience is not allowed to become Licensed or Certified Residential Appraisers.

Social Media Links

Did you know……

The Division of Real Estate is on Facebook and Instagram making it easier than ever to stay connected and in the know!

Both are great places to stay up to date on renewal dates, deadlines, rule and industry updates, event announcements, and much more. Click the links below and be sure to follow our pages!

Credits

Director: Leigh Veillette

Interim Director: Justin Barney

Editor/Contributor: Justin Barney

Editor/Contributor: Mark Fagergren

Contributor/Layout: Sandra Bargas

Contributor: Kadee Wright

Contributor: Justin Barney

Contributor: Van Kagie

Contributor: Laurel North

Contributor: Jenae Luthi

Contributor: Lark Martinez

Contributor: Matt Hastings

Contributor: Adam Martin

Webmaster: Patrick Fitzgibbon

2024 Published by

Utah Division of Real Estate

Department of Commerce

160 E 300 S

PO Box 146711

SLC UT 84114

(801) 530-6747

Real Estate Commissioners

Marie McClelland, Chair

Andrea Wilson, Vice Chair

Randy Smith

Rick Southwick

James Bringhurst

Mortgage Commissioners

Allison Olsen, Chair

Christy Vail, Vice Chair

Gina Johnson

Jeff Flitton

Jeff England

Appraiser Licensing and Certification Board Members

Jeffrey T. Morley, Chair

Keven Ewell, Vice Chair

Ben Brown

Kris Poulson

Richard Sloan

Kelle Smart